Fear has the ability to shut down your trading business, by flooding your decision making system. The good news is it is detectable as a bodily sensations. So visceral that anyone, if they know about it, can see it coming and stop fear from taking over the steering wheel.

The vast majority of catastrophic trading losses trace back to just six fears that hijack decision making in a fraction of a second. FOMO, loss aversion, ego, greed, trauma, and fear of size: these are the invisible architects of blown accounts, years of erased P&L, and the slow psychological erosion that grinds even the sharpest edges into dust. But here’s where it gets interesting. What looks like a weakness is actually a weapon if you know how to wield it.

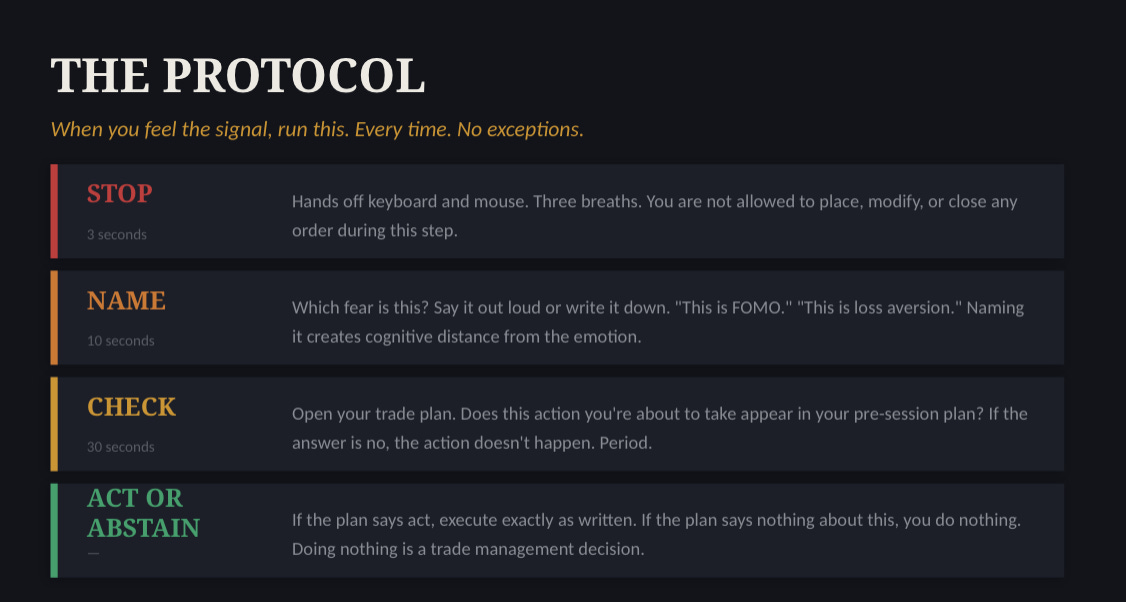

We deliver a 4-step protocol, executable in under 60 seconds, that transforms fear from a portfolio killer into a trade signal generator. Some of the best strategies were born directly from recognizing these fear patterns and flipping them. Cut just 10–15% of your worst trades, and the trajectory of your P&L goes vertical.

Six fears account for nearly every catastrophic trading decision and each produces a detectable physical signal before you act on it

A 60-second, 4-step protocol (Stop → Name → Check → Act or Abstain) can intercept left-tail events and transform fear into actionable intelligence

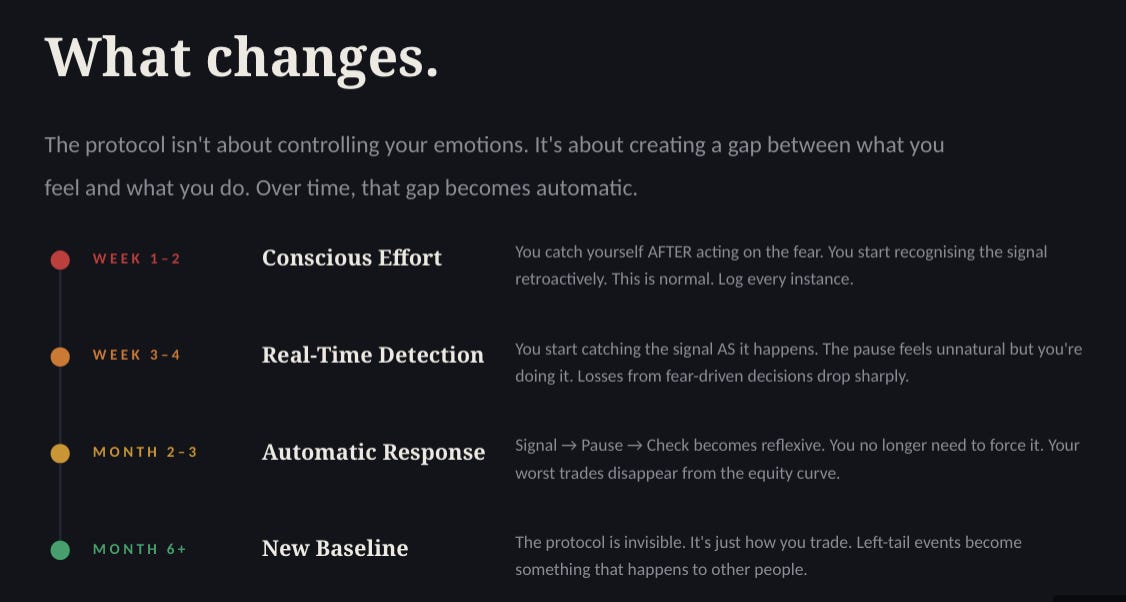

Neuroplasticity research suggests 6–9 months of consistent practice rewires the brain’s fear response permanently

The Six Fears That Destroy Trading Careers

Every blown account begins the same way. A signal fires in the body. It gets ignored. And then the trader acts from the fear rather than on the information it carries. The pattern is devastatingly consistent and it operates in microseconds, making it almost impossible to catch without deliberate training.

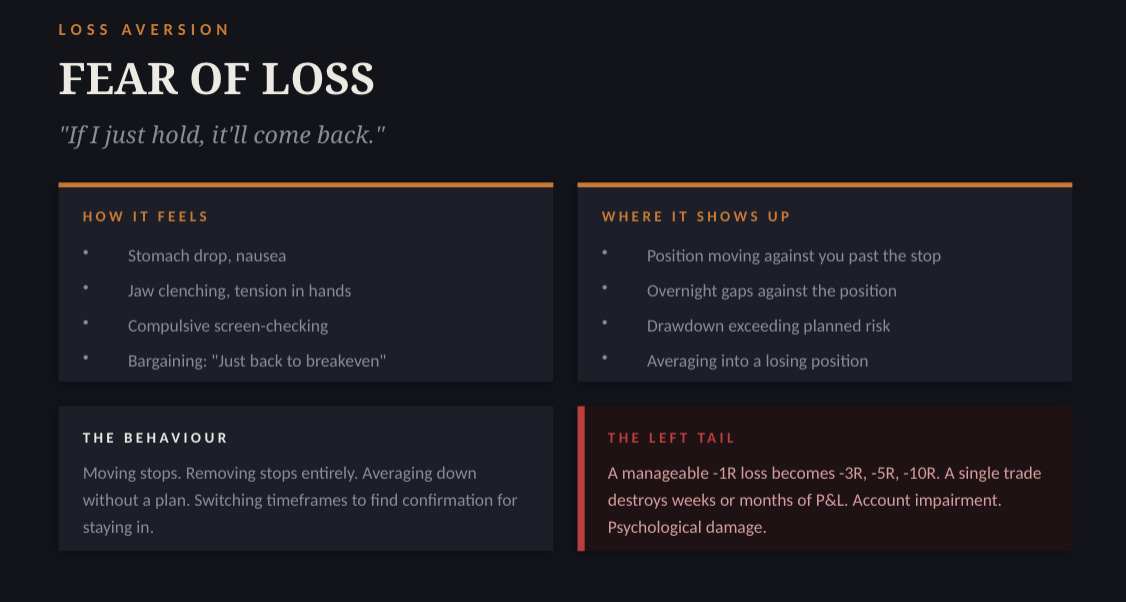

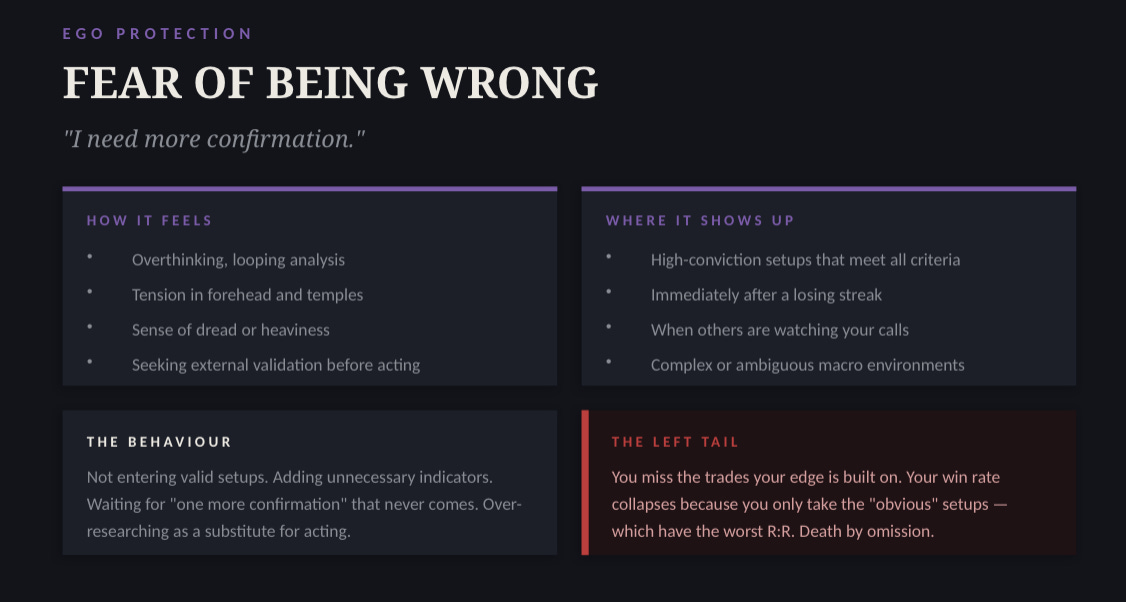

Six core fears that account for virtually all catastrophic trading decisions. Understanding where each one hides, how it feels physically, and what behavioral cascade it triggers is the first step toward neutralizing years of compounding damage.

The Catalogue of Destruction

What makes these fears especially dangerous is their tendency to stack. FOMO and ego can fire simultaneously. Trauma and greed can cross over in the same moment. The compounding of multiple fear signals creates a decision-making environment so contaminated that even a trader with a proven positive-expectancy edge will systematically destroy their own results. Think about it: you’ve spent months, maybe years, building a system with genuine positive expectancy, only to watch it implode because an undetected micro-signal in your chest or gut triggered a behavioural cascade you didn’t even know was happening. The fear fires, the body sends its warning, and it gets ignored because it happens in a microsecond. By the time you realize what occurred, weeks of P&L have vanished. And the cruelest irony? It doesn’t matter if you’ve been trading two months or twenty years. These signals are unanimous across all of us, if you’re human and money is on the line, fear will find you.

The signal is the gift. Every fear produces a detectable physical signal before you act on it. That signal is your body’s early warning system, given to you for free. Most traders never learn to detect it. That changes now.

Consider this FOMO example: a trader wants to short USD/JPY, but the pair has already moved 50 pips. Instead of the planned 10 lots, they enter 20 lots doubling exposure for no reason other than the fear of missing the move. Sometimes they enter without a defined stop. The reversal catches them oversized and overextended. One fear signal, ignored for a microsecond, and weeks of disciplined work evaporate.

The 60-Second Protocol: From Fear to Edge

The breakthrough isn’t about eliminating fear. You cannot control emotions, you can only reappraise them. The protocol creates a gap between what you feel and what you do, and that gap is where the magic happens.

The Four Steps

Total elapsed time: under 60 seconds. The cost of avoiding a career-defining left-tail event.

Doing nothing is a trade management decision. We are all brought up to feel that inaction means laziness. Trading is different. When doing nothing comes from a four-step process built on years of discipline, you can trust it completely.

This protocol has a compounding timeline rooted in neuroplasticity. Weeks one through two require conscious effort. By weeks three to four, real-time detection begins. At two to three months, the response becomes automatic. And by month six to nine, a new neurological baseline is established. The brain literally rewires itself when you exercise a pattern consistently and that rewiring is permanent.

Key Takeaways & Outlook

The convergence presented in this session is rare: a complete psychological operating system paired with one of the cleanest macro setups in G10 FX. The six fears FOMO, loss aversion, ego, greed, trauma, and fear of size, are not obstacles to be eliminated but signals to be harnessed. The 4-step protocol (Stop, Name, Check, Act or Abstain) costs under 60 seconds and can intercept the left-tail events that destroy months or years of work. Some of the best strategies emerged directly from recognizing and flipping these fear patterns underscores the transformative potential.

Disclaimer: This is not financial advice, just market analysis derived from the charts and discussion. Always conduct your own research.

Trade Strong

Miad