High Level Summary

In this week we tackle the fundamental question: “How do I go about structuring my trading and build wealth?” The answer requires a profound shift in perspective, moving away from immediate monetary goals toward dedicated skill development. This session provides a detailed roadmap for mastering the trading profession. We confront the sobering statistics of the industry data suggests between 70% to 90% of retail traders lose money long-term, and recent Taiwan Stock Exchange data showed only 1% of day traders generated profit over a three to six-month period. The key realization? Trading is a business where your skills generate income, and success depends on who you need to become.

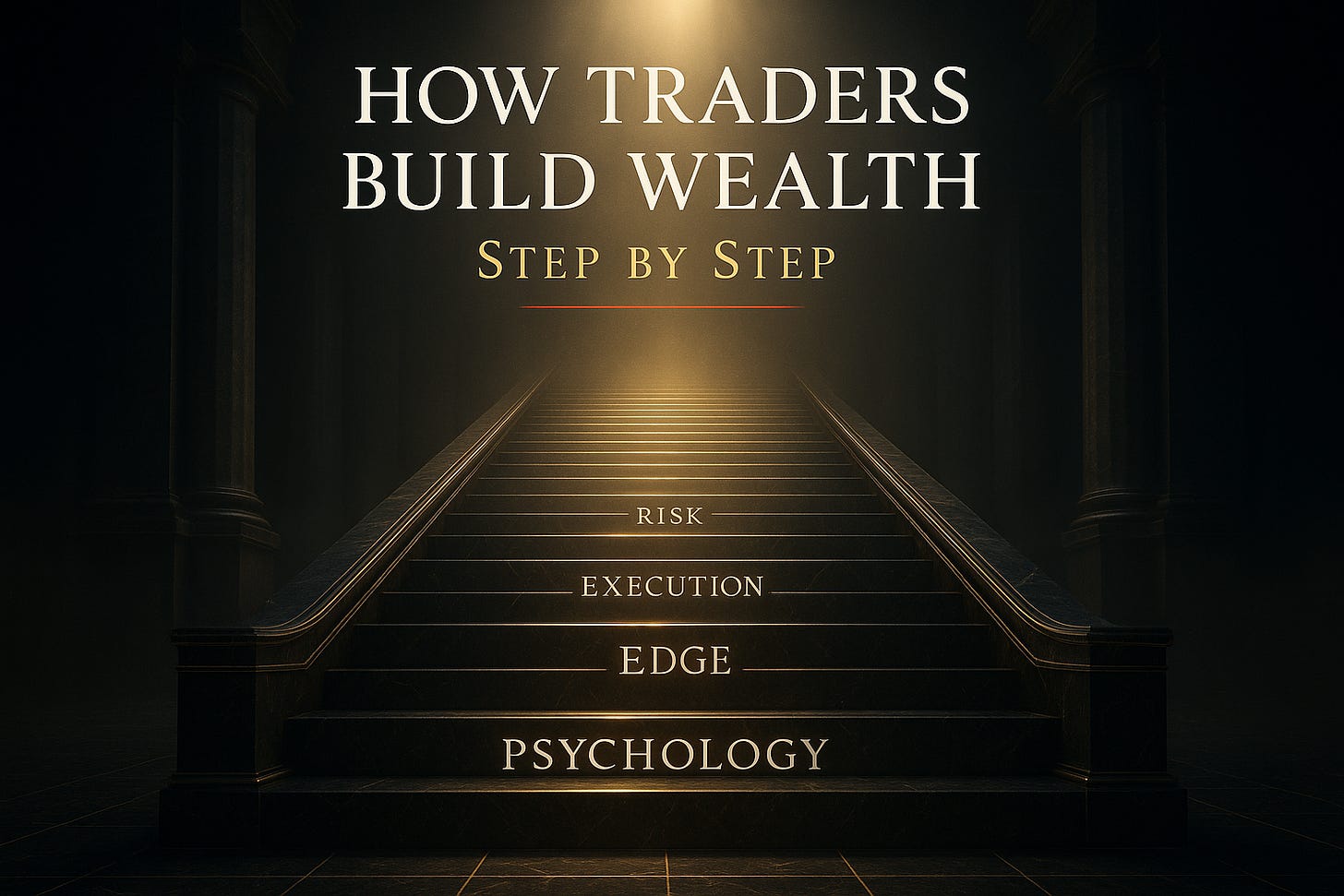

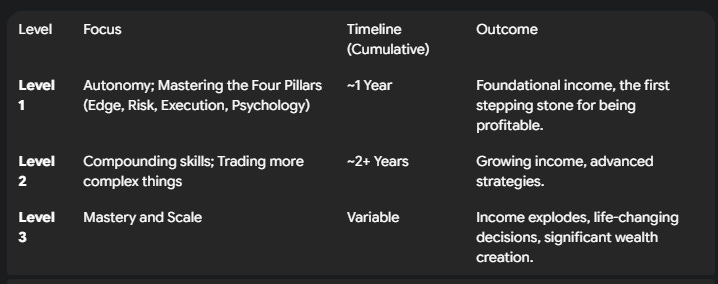

Sustainable wealth creation rests on four essential and interconnected pillars: Edge, Risk Management, Execution, and Psychology (The Success Formula). We delve into the multiplicative nature of these skills, illustrating why proficiency in one area cannot compensate for a deficit in another; if any skill is zero (e.g., value of $25,000 Edge x $50,000 Execution x 0 Risk x 0 Psychology), the resulting income is zero. Developing these skills is a long-term commitment. Leveraging the brain’s plasticity, it takes approximately three months to achieve basic proficiency in each skill, meaning traders should expect a minimum one-year timeline to reach “Level 1” autonomy. This journey progresses through stages, eventually reaching “Level 3,” where life-changing wealth creation becomes possible.

Key Takeaways from this Session:

Wealth Through Skill: Income in trading is directly tied to skill level across the four essential pillars, which are multiplicative.

Realistic Timelines: Expect at least one year to develop foundational skills (Level 1) across Edge, Risk, Execution, and Psychology.

The Foundations of Wealth: Skill Development and Realistic Timelines

The session begins by addressing a core question sent over by a viewer: “How do I go about structuring my trading and build wealth?” This is a great question worth looking at from a different angle. Many traders start by asking the wrong questions, such as “How do I make my money in trading?” or wondering what is missing when they feel they should be making more money, but it hasn’t really come yet.

Realistically, when it comes to trading, it’s not about when you are going to start making a specific amount of money on a certain timeframe. The focus must shift to being realistic about who you need to become. It requires the recognition that there are no shortcuts. You build skills, and those skills start paying you back. That’s really what trading is. You’re in a business where you take an idea, test it, and over time your skill decides whether that idea turns into income.

The market doesn’t reward opinions it rewards ability. Every hour you spend refining your process, reading market, managing risk, builds something that can pay you for years. That’s the part most people miss

The Stark Reality: Statistics and Skill

Before diving into the skills required, it is crucial to understand the statistical reality of the industry. Most retail traders lose money. There is data suggesting that between 70% to 90% lose money on a long time horizon. Even more striking, recent data from the Taiwan Stock Exchange stated that only 1% of day traders actually generated money over a three to six-month period.

Given these figures, the question isn’t, “How do you make money out of this market?” The question is, “Who do you need to become, to actually have those skills, to then generate that income you’re looking for?”

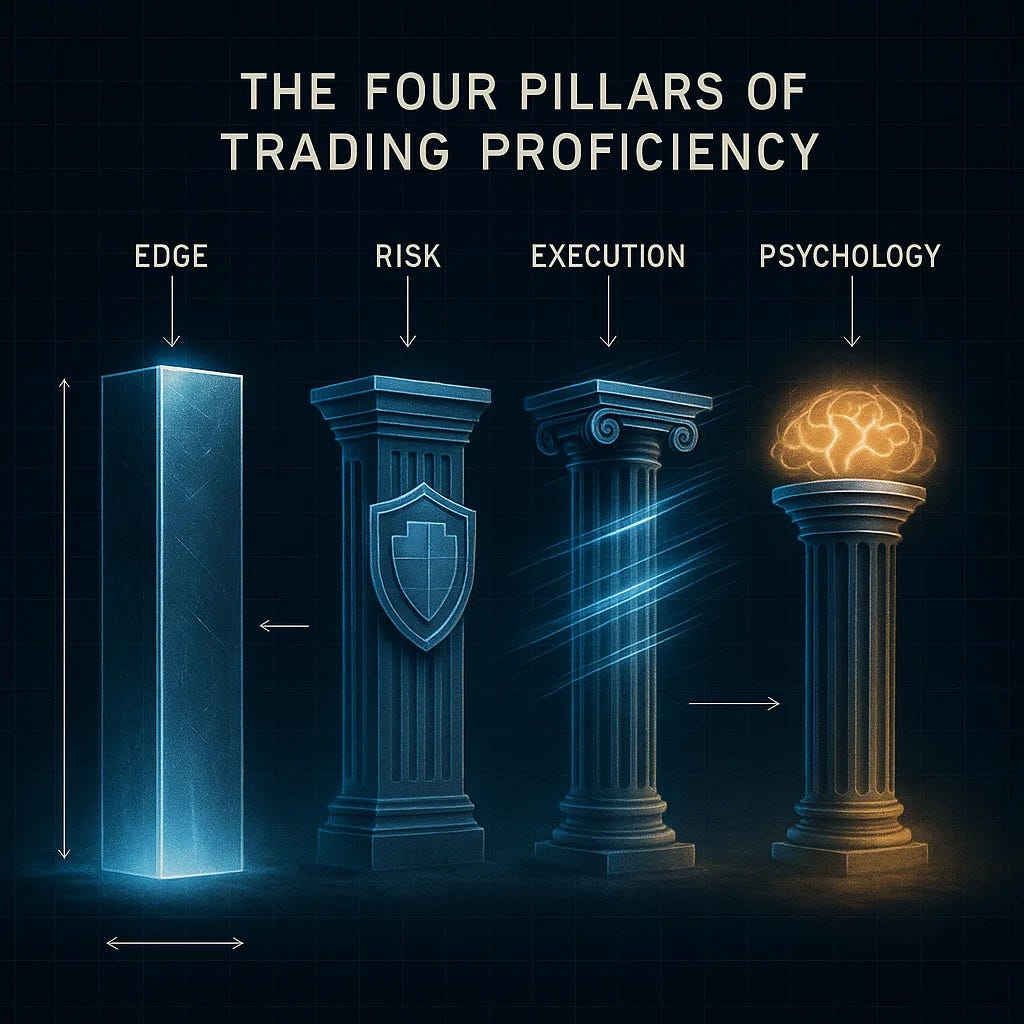

The Four Pillars of Trading Proficiency

There are four paramount skills that over time, we all need to work on. It takes time to create these skills, but also time to understand what skills are actually worth pursuing. The four skills are:

Edge: The specific strategy or advantage you hold in the market.

Risk (Risk Management): The ability to manage capital exposure and protect the trading account.

Execution: The skill of implementing the trading plan accurately and efficiently.

Psychology: The mental capacity to manage emotions and maintain discipline.

You might think one is more important than the other; it actually isn’t. They develop over time, like a muscle you develop. We break down each skill in detail, showing how it develops over time.

Edge

Edge is the statistical advantage you hold in the markets. It might come from a recurring pattern, or a sequence that leads into a high-probability setup with a strong payout. What makes it valuable is that it’s repeatable it shows up often enough for you to execute consistently.

An edge can take many forms. Sometimes it’s a statistical anomaly, like the way we trade inside bars, failures, or liquidity magnets. Other times it’s your ability to read the broader macro landscape to compress hundreds of data points into one clean directional call.

For an edge to be real, it has to hold up to a few simple tests:

It’s repeatable.

It appears often enough to act on.

It gives you an advantage over other participants, in either timing or context.

It has positive expected value (EV).

It’s specific to an asset, situation, or market environment.

An edge that satisfies all of these and does so consistently is worth developing. That’s what you can build a trading business upon.

Risk

Risk is how you stay alive long enough to profit. It isn’t only about how much you lose when wrong it’s about how well you read the environment to adjust exposure before the market teaches you the hard way. When volatility compresses, risk can expand. When assets stretch to extremes of their weekly or monthly range, risk steps in to arrest the trade.

A trader who sees risk dynamically who scales in when probabilities align and scales out when they decay operates more like a portfolio manager than a gambler. Scanning the environment gives you the signal to reduce, add, or even press harder. The point isn’t to avoid risk; it’s to assign it intelligently so your edge can express itself over time.

Constantly read the environment before sizing.

Reduce when markets stretch; scale when conditions favor you.

Risk that adapts is risk that survives.

Execution

Execution is where theory gets traction. Every market phase asks for a different rhythm, some demand the patience of a second or third attempt, others require that you stop altogether and wait for clarity to return. In ideal conditions, execution feels almost choreographed: clean entry, managed add-ons, precise exit.

Good execution isn’t just “when to click.” It defines where to enter, how to scale, when to move stops and break even manuveurs. It transforms randomness into structure. A solid plan frees mental bandwidth so decisions flow instead of freeze.

Execution adapts to the market’s state.

Your plan defines not just if but how you act.

Scenario analysis and execution plans are common and a must

Psychology

Psychology is the invisible hinge holding everything together. It doesn’t show itself when things go well, it is most felt when nothing does. When you can’t seem to follow your plan, when the market feels personal, that’s not a strategy issue, it’s signal interference, and almost always ego.

Trading requires emotional intelligence of both yourself and the market. The same awareness that stops you from overtrading also sharpens your read of crowd behavior at turning points. Research in performance science links the skill of reappraising emotion not suppressing it with outsized long-term returns.

Psychology is what converts experience into intuition. It’s the upgrade that lets you hold conviction through uncertainty and reset after chaos.

Emotional regulation amplifies decision quality.

Awareness of market emotion mirrors awareness of self.

Mastery begins when you can observe your reactions without being ruled by them.

Somatic reads and Engrams will unlock your Edge even further

The Multiplicative Effect: Why All Skills Matter Equally

The critical realization is that these four skills are multiplicative, not additive. After some time, perhaps six months of trading, you might find you’ve got some form of an edge (one star). After a year, you might find you are very good at execution (two stars). In any other business, you might think at this stage you should start pulling in some numbers.

However, in trading, the multiplicative nature changes everything. If we were to put a figure on it:

Let’s say your Edge is worth $25,000 a year.

Let’s say your Execution is worth $50,000 a year.

However, if your Risk Management is 0.

And if your Psychology is 0.

The equation is: 25,000 x 50,000 x 0 x 0 = Absolutely nothing.

That is where loads get stuck. You cannot have edge up and execution up and really bad risk management or no psychology skills. They are going to end up letting you down. All of these skills multiply over time. If you don’t spend time developing them, they will eventually set you back. You need to have some traction on all skills to move forward.

Once you develop all of them and they together pull each other up, that is when the market will start paying out, the income will be palpable, and the money starts coming in. You need “three stars everywhere.”

Furthermore, these skills are deeply connected with each other:

Edge feeds back into your Psychology.

Psychology feeds back into Execution.

Execution feeds back to Risk.

Risk feeds back to Edge.

Risk is also part of Psychology.

They are all connected, and all of this leads to generating decent money.

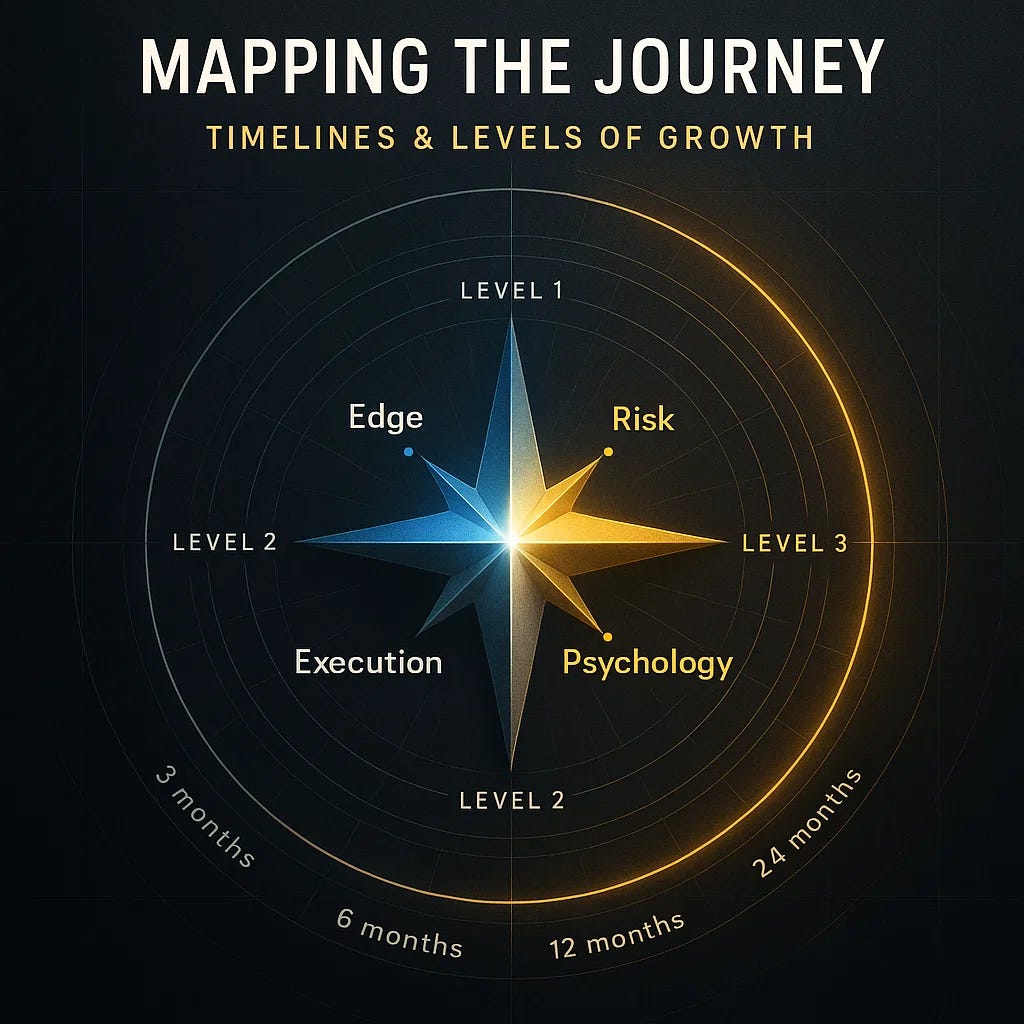

Mapping the Journey: Timelines and Levels of Growth

Now that we have established the required skills, what sort of timelines can traders expect? We can visualize this development as angles of a star:

Execution: How well can I actually execute a trade?

Psychology: How well can you hold your nerves throughout a trade, before a trade, after a trade, when the market is choppy?

Risk: How good am I at allocating risk when times are bad, when times are good (e.g., recognizing fat tails)?

Edge: How good is actually the edge I am executing?

Every “aha moment” or improvement better recognition of the edge, better execution matching your backtests and forward tests is another piece of that star.

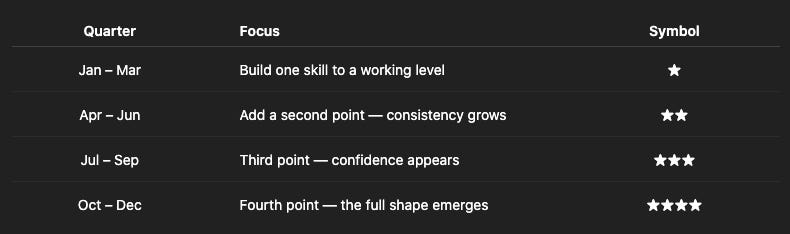

Based on experience and research regarding brain plasticity (the brain’s ability to learn anything), it takes roughly three months to develop one skill to a basic level.

If you start in January:

January, February, March: By around April, you would added “1 Star” to a skill.

April, May, June: You get another star.

July, August, September: Another star.

October, November, December: Another star.

After a year, you are just about Level 1 across all four elements. That is the timeframe you are looking at. A year after that, if you stick to all of those, you will progress towards Level 2.

Income moves in tandem with skill. This is true in every industry, particularly in trading.

Challenges and the Non-Linear Nature of Growth

The challenges in trading are that these skills are all tied together; if one lacks, all of them lack. In other industries, you might compensate for a weakness (e.g., poor communication or customer relations) by leveraging a strength (e.g., computational skills) or delegating the task. In trading, if you’re not good at psychology, there’s no one else to fix it for you. It’s all you. If you’re not good at risk management, the market will just take all your money.

In reality, you develop all four skills simultaneously, but the growth comes in stages, years apart and follows different patterns. You have to have the maturity to understand how growth works in trading:

Risk Management: Growth might be in steps you might not do much in the beginning, and then trade by trade iterate and grow.

Edge: Growth might start strong, then involve a massive plateau before your edge evolves more.

Psychology: Nothing much happens, and then all of a sudden it’s that epiphany that just drives you to new levels.

Execution: You will stick to the very basics, many repetitions. Amateurs train until they get it right, professionals train until they can’t get it wrong, be a pro. Execution evolves together with your other pillars.

It is vital to develop all skills. You can have the best edge, but it is worth nothing if you have no idea how to allocate risk. Above all, even with good execution, risk management, and edge, bad psychology will cause it all to fall apart sooner or later, because psychology helps immensely when there is a lot of money on the line, particularly when you are Level 3.

As emphasized in the session: “A lot of people overestimate what they can achieve in a month. And massively underestimate what they can achieve in a year.” Once you have a plan, all of this becomes much easier. To collect these stars and develop your skills we have created a community, with training material and weekly livestreams including direct dm access to me and lead traders. To help you understand each skill and become a high level trader. If this sounds like you, you can join us directly here.

⭐ The Star Path

Each star represents one of the four skills Edge, Risk, Execution, Psychology.

Every time you refine one of them, a new star lights up.

Key Takeaways and Outlook

This session provided a dual framework for approaching the markets, blending long-term skill development with immediate tactical analysis. The path to sustainable wealth in trading is unequivocally tied to mastering the four essential skills: Edge, Risk Management, Execution, and Psychology. Recognizing their multiplicative nature highlights that a deficiency in one area nullifies strengths in others. The journey to “Level 1” proficiency requires patience and structure, taking approximately 12 months. Remember: “A lot of people overestimate what they can achieve in a month. And massively underestimate what they can achieve in a year.”

Miad

If you enjoyed this deep dive, please share it with fellow traders!