Market Situation Report: Bitcoin’s “Tiger Cage,” NVIDIA's Iron Grip on NASDAQ, and the Institutional Trap for Ethereum

Executive Summary

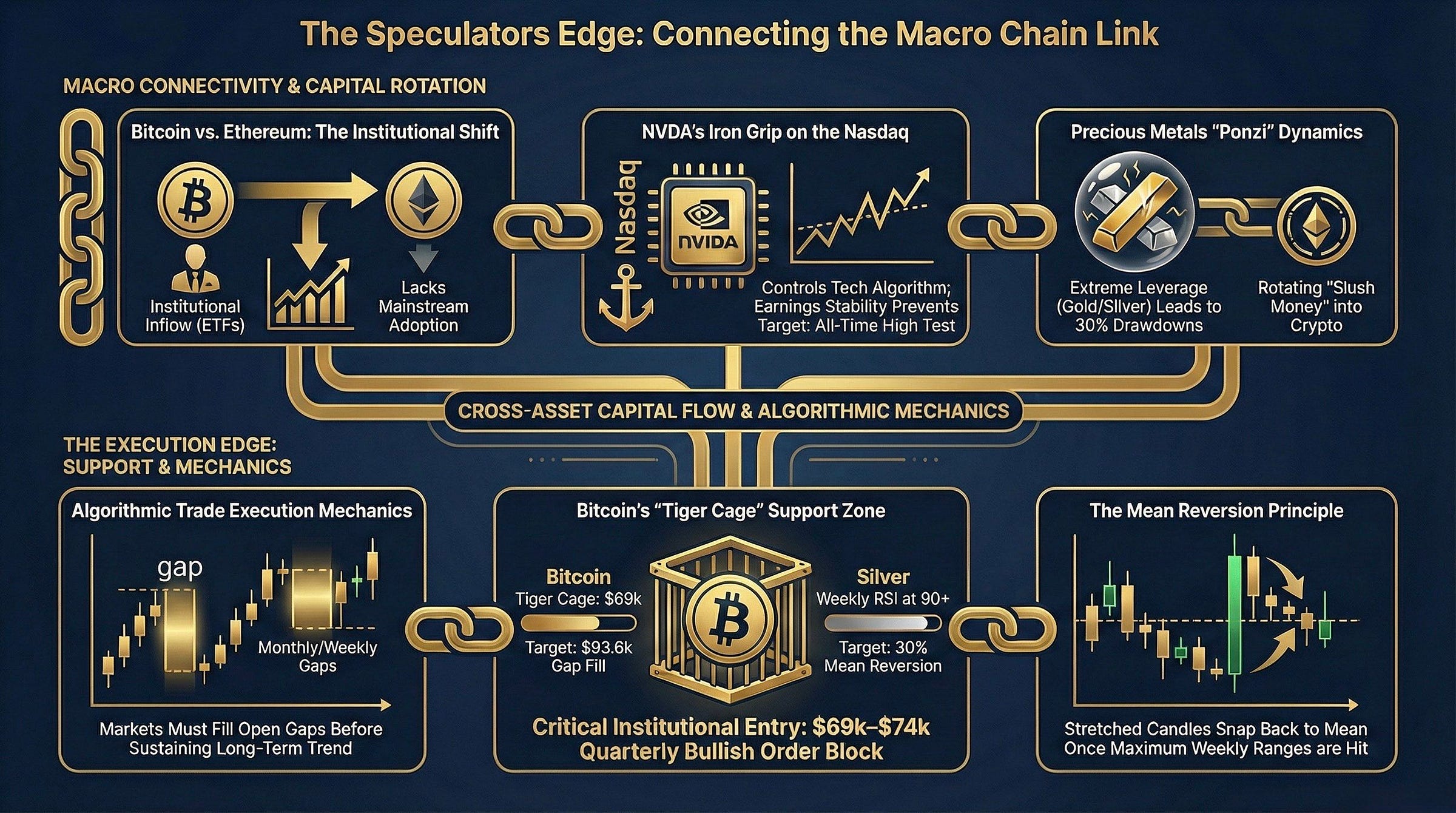

As we transition into the month of February 2026, the global financial landscape is characterized by a stark dichotomy between the explosive expansion seen in the crypto markets and the sideways, range-bound stagnation of the NASDAQ and S&P 500. Over the past three months, traditional indices have remained virtually frozen, creating a psychological sense of “eternity” for traders who feel the market is failing to move ahead in time. However, this period of inertia is coming to an end as we open the February monthly candle. We are currently approaching a very, very pivotal level across all major asset classes, necessitating a meticulous mapping of Support and Resistance (S&R) levels to navigate the upcoming volatility.

The primary focus of this outlook is Bitcoin (BTC), which is entering a high-timeframe support zone described as the “Tiger’s Cage.” This area, situated between $70,000 and $74,500, represents a massive fair value gap on the quarterly chart. As Bitcoin mean-reverts from its extremely stretched bull run, which saw five consecutive six-month green candles, we are witnessing the “mother of all liquidations.” This process is not merely a price capitulation; it is a psychological capitulation. For a bear market to bottom out, it requires a prolonged accumulation cycle, often lasting roughly 200 days (six months), where retail interest evaporates and despair takes hold. While current headlines might blame geopolitical risks or tariffs, the reality is a standard leverage unwind. This provides a generational opportunity to position into spot longs for a two-to-five-year horizon, particularly as the IBIT ETF prepares to open with a massive monthly gap that the algorithm is incentivized to fill.

In the equities space, the narrative is dominated by the XLK (Technology ETF) and its primary constituent, NVIDIA. Despite the “inside monthly candle failure” patterns appearing on the NASDAQ which suggest downside can grip the Index, it is important to note that market structure remains fundamentally bullish. NVIDIA has shown immense unwillingness to break down, even as peers like Apple and Microsoft suffered drawdowns. With earnings scheduled for February 25th, the “earnings trajectory” suggests NVIDIA is actually underweight relative to its growth, pointing toward an upside move to clear inefficiencies before any potential post-earnings correction. Meanwhile, the S&P 500 has just posted its highest monthly close ever, reinforcing the “higher high, higher low” trend.

This post will exhaustively detail the trade setups for Bitcoin’s counter-trend rally, the institutional rejection of Ethereum, high probability long setup for SPX500, the explosive “pennant” formation in the Nikkei ahead of Japan’s snap elections, and the USD/JPY swing target of 158.179. We will examine why the current drawdown is not a “crisis”, but a necessary mean reversion. What does this mean for your portfolio? It means the “dry powder” you have been holding is about to meet its highest-probability entry points of the year

Bitcoin Analysis: The Higher Timeframe Framework

Higher Timeframe Levels and The “Tiger’s Cage”

To engage with the market successfully, one must start from the highest timeframes. On the quarterly chart, the most significant level is the previous all-time high (ATH) formed in October 2021, sitting at approximately $69,000. Currently, the market is fixated on the “empty space” or fair value gap existing between the current quarter’s high and low. This gap is the primary “draw on liquidity.”