Market Situation Report: Pre FOMC prep Part 1

Executive Summary

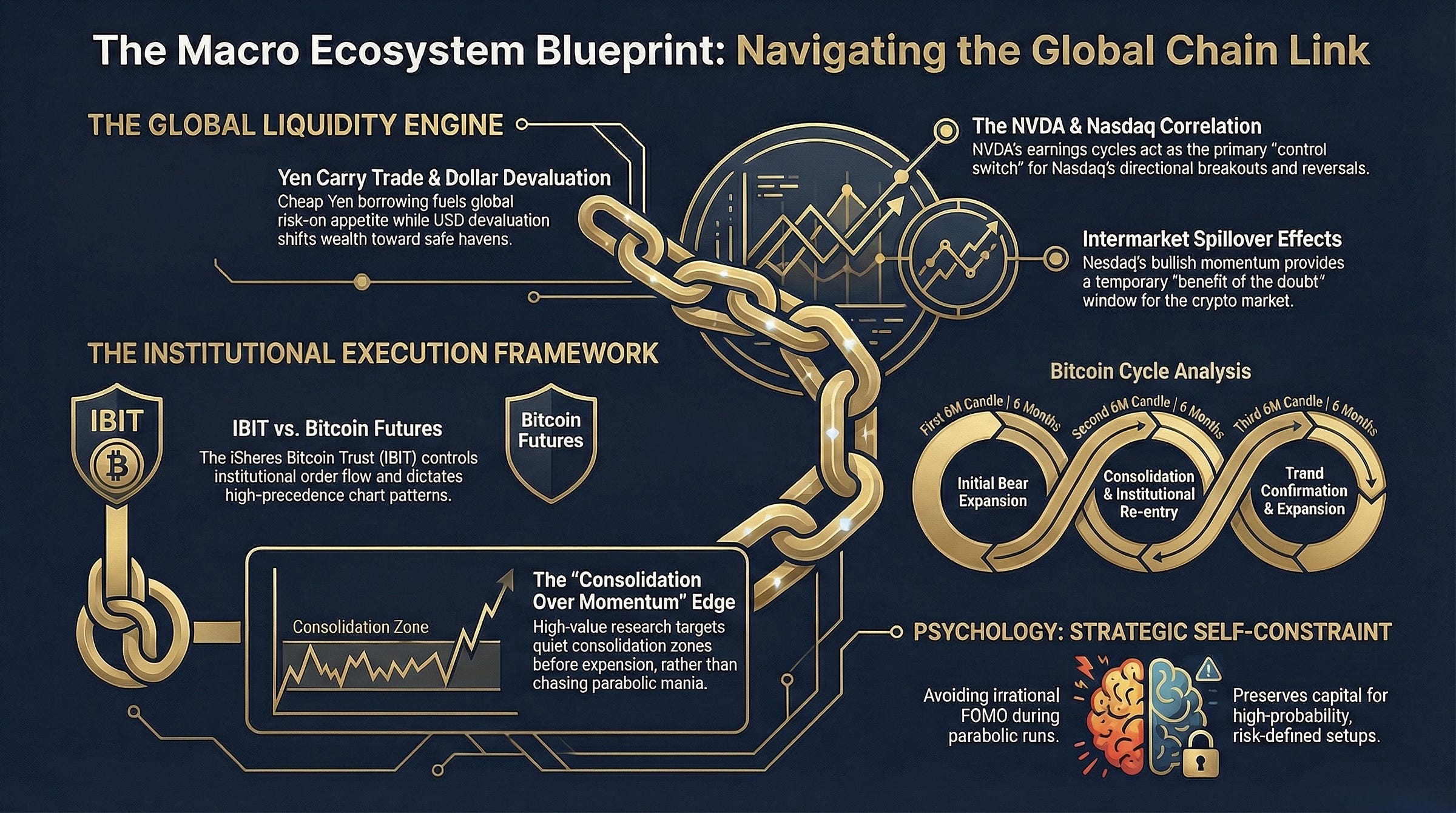

As we kick off this bi-weekly series, the global market landscape is shifting into a period of extreme divergence and rotation. While the primary focus of this session centers on the cryptocurrency sector and forex currencies, the underlying mechanics are inextricably linked to a massive, ongoing currency devaluation: specifically within the US Dollar and the Japanese Yen. We are witnessing a market where traditional correlations are being tested; the NASDAQ is showing signs of a breakout, fueled by NVIDIA’s upcoming earnings and the “slush money” of the Yen carry trade, while Bitcoin (BTC) remains trapped in a complex high-timeframe bearish structure. This isn’t just noise; it’s a structural shift that requires a tactical pivot from “buy and hold” to surgical entry and exit management.

What does this mean for your portfolio? It means we are approaching a “line in the sand” moment where capital preservation and tactical positioning outweigh general optimism. For Bitcoin, we are tracking a confirmed inside four-month candle failure that points toward a primary drawdown to the $74,508 level: the previous year’s low. This isn’t merely a guess; it is a structural necessity derived from the institutional order flow seen in the IBIT (iShares Bitcoin Trust), which now dictates the market’s primary direction over traditional futures. We explore the psychological trap of “flat opens” and why the market’s failure to tag the $98.2k S/R zone has created a lingering inefficiency that must be resolved. Tactically, we are in a “no-man’s land” for BTC; the risk-reward for shorting at current levels is sub-optimal, but the case for longs is non-existent until the downside liquidity at $74k is swept or a structural shift, evidenced by multiple tests of resistance with higher lows occurs.

Simultaneously, we dive into the “Valentine’s Day Reversal” theory. By drawing direct historical parallels to NVIDIA’s 2021 price action, we project a rally into mid-February followed by a sharp U-turn. During that 2021 period, NVIDIA staged a massive vertical rally that ran the highs just days before reporting, only to drop 11% in 30 days post-earnings as it hunted downside stop losses. This has massive implications for Ethereum (ETH), where a potential double inside monthly candle is forming. We have mapped out a high-conviction short setup for ETH at the $3,477 - $3,500 range, offering a 4.63 risk-reward ratio as it mirrors the catastrophic 2022 drop. For traders, the play is to wait for the “counter-trend spike” triggered by Big Tech earnings to enter these short positions at the SR level top.

Beyond crypto, the Forex markets are offering the cleanest risk-reward setups in years. EURUSD and GBPUSD are finally breaking out of multi-month consolidations, with DXY (Dollar Index) positioning for a lower high that offers a 9.28 RR short opportunity. Tactically, we are monitoring the Yearly Open on the DXY; a tag of this level is the ultimate “green light” to go long on EUR/USD and GBP/USD on any pullbacks. We examine the Yen Carry Trade mechanics, the Japanese snap elections on February 8th, and why the global “risk-on” appetite is being subsidized by the Bank of Japan’s debt expansion. If the current PM secures her majority, expect the Yen devaluation to accelerate, further fueling the “slush money” rotation into the NASDAQ and eventually Bitcoin.

This post provides the exhaustive roadmap you need to navigate these rotations. From Bitcoin’s six-month candle theory : which suggests we are currently in the “accumulation/consolidation” phase of the second candle to the 1,300% run up that potentially awaits once the $69k–$74k support zone is secured, we cover it all. We are looking at a 3-5 year window where institutional firepower, facilitated by the IBIT options market, could drive Bitcoin to the million-dollar mark. But before that “Moon” scenario, you must survive the February flush.

Main Takeaways:

Tactical BTC Target: Patiently wait for $74,508 for spot accumulation; avoid leverage in the $80k-$90k range as there is no lucrative risk/reward being offered for longs, it is simply a chop zone.

ETH Short Setup: Entry at $3,477, Stop at $3,660, Target $2,628 (4.63 RR). Use the mid-February “Valentine’s” pump as the entry window.

DXY Strategy: Short the Dollar at the Yearly Open (98.235), which is a proxy to play the 1.23495 target on EURUSD.

Historical Parallel: NVIDIA’s February 25th earnings will likely act as a “Sell the News” event, similar to the 2021 cycle, triggering a broader crypto drawdown.