Market Situation Report: The “Tiger’s Cage” Volatility, Bitcoin’s Wickless Warning, and the SpaceX IPO Supercycle

Executive Summary

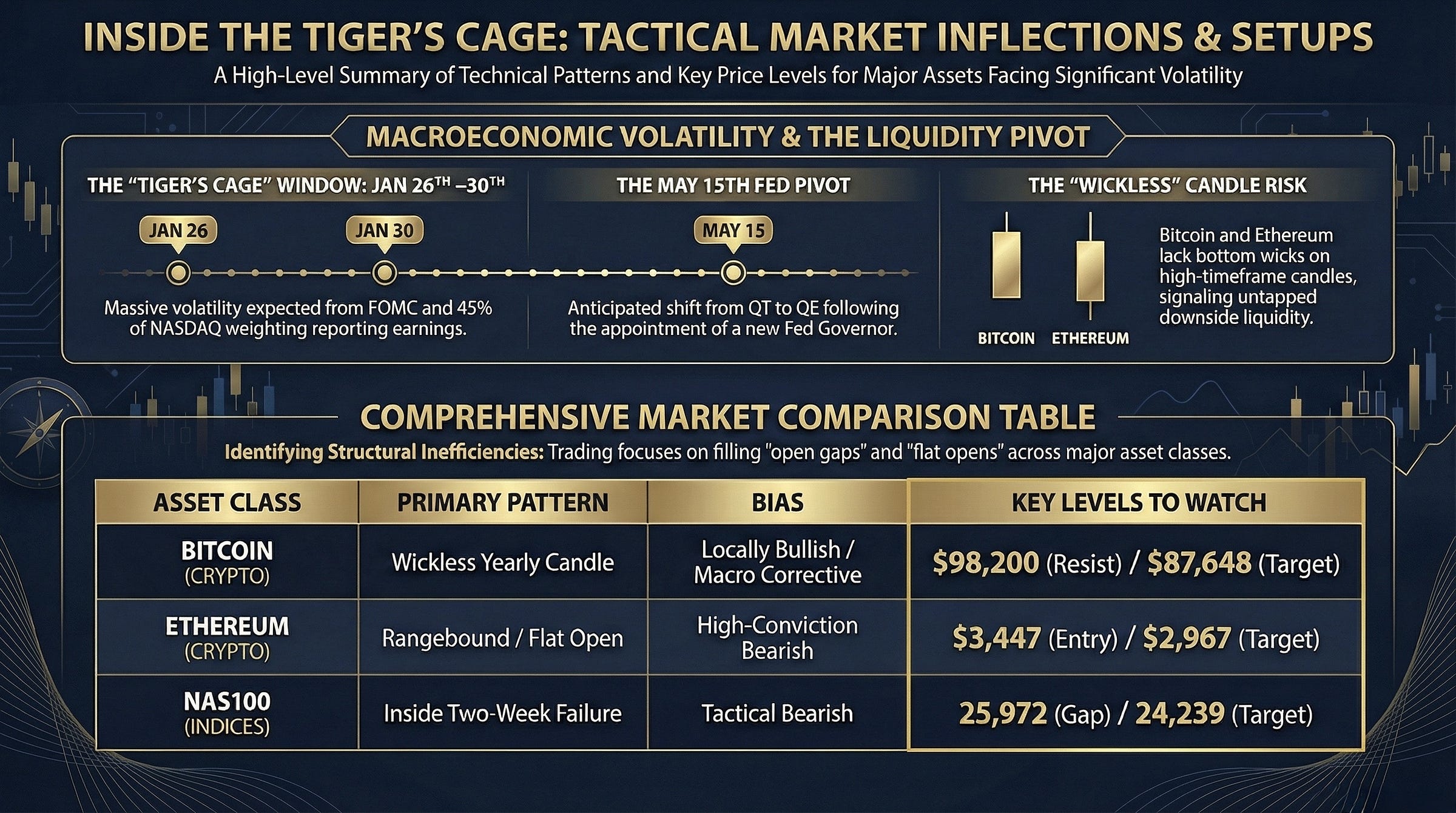

The current market environment is characterized by a high-stakes convergence of technical inefficiencies and massive macroeconomic catalysts. As we navigate the third week of January 2026, the primary focus rests on the structural anatomy of Bitcoin and Ethereum, both of which are reaching critical inflection points. For Bitcoin, we are tracking a counter-trend rally that successfully defended the $90,000 S/R level, yet significant alarm bells are ringing due to the “wickless” nature of the quarterly and yearly candles. Historical price action suggests that Bitcoin rarely leaves flat opens unvisited; the absence of a proper downside stop run below the yearly open ($87,648) suggests that the current expansion might merely be the formation of an upper wick before a corrective flush.

What does this mean for your portfolio? We are entering a “Tiger’s Cage” over the next two weeks. Between January 26th and 30th, the market faces a trifecta of volatility: the FOMC meeting, a deluge of Big Tech earnings (Apple, Microsoft, Amazon, Meta, Tesla, Google, Netflix), and escalating geopolitical tensions regarding the Trump administration’s interest in Greenland and potential escalating European tariffs. While indices like the NASDAQ have remained in a seven-week consolidation, the banking sector (XLF) is signaling that liquidity is beginning to flow back into the system, a precursor to the anticipated shift from Quantitative Tightening (QT) to Quantitative Easing (QE) once the new Fed governor takes office after May 15th, 2026.

This report explores tactical trade setups, including short trade setup on BTC targeting…

87,500$ and a high-conviction swing short on Ethereum targeting the $2,967 flat open at Yearly open. We also analyze the “Bubble Dynamics” currently visible in Silver, which exhibits every signature of a classic overextended Ponzi, and the emerging Space Sector supercycle catalyzed by the impending SpaceX IPO. By aligning technical patterns like the Inside Two-Week Candle Failure prevalent in NAS100 with macroeconomic shifts, traders can navigate this volatility with precision. Are you prepared for a potential 10-15% index correction, or will the liquidity flood override the technical gap