Q1 2026 Quarterly Market Outlook: The Institutional Crypto Takeover, AI-Energy Bottlenecks, Precious Metals Bubble Dynamics, and Policy Stimulus Catalysts

Executive Summary

Welcome to the Q1 2026 Quarterly Outlook. As we open the new year, we are essentially “wiping the slate clean.” This is the period where the market algorithm resets its reference points, transitioning from the volatility of 2025 into a highly structured, liquidity-driven environment. Our analysis today is rooted in a top-down methodology, starting from the quarterly candles and drilling down into the monthly, 3-week, and daily charts to map out a precise game plan for the next three months. We are currently witnessing a rare alignment of technical patterns—specifically the Inside Monthly Candle on the NASDAQ and the multiple Inside Weekly Candles on USD/JPY—which suggest we are at the precipice of a violent expansion.

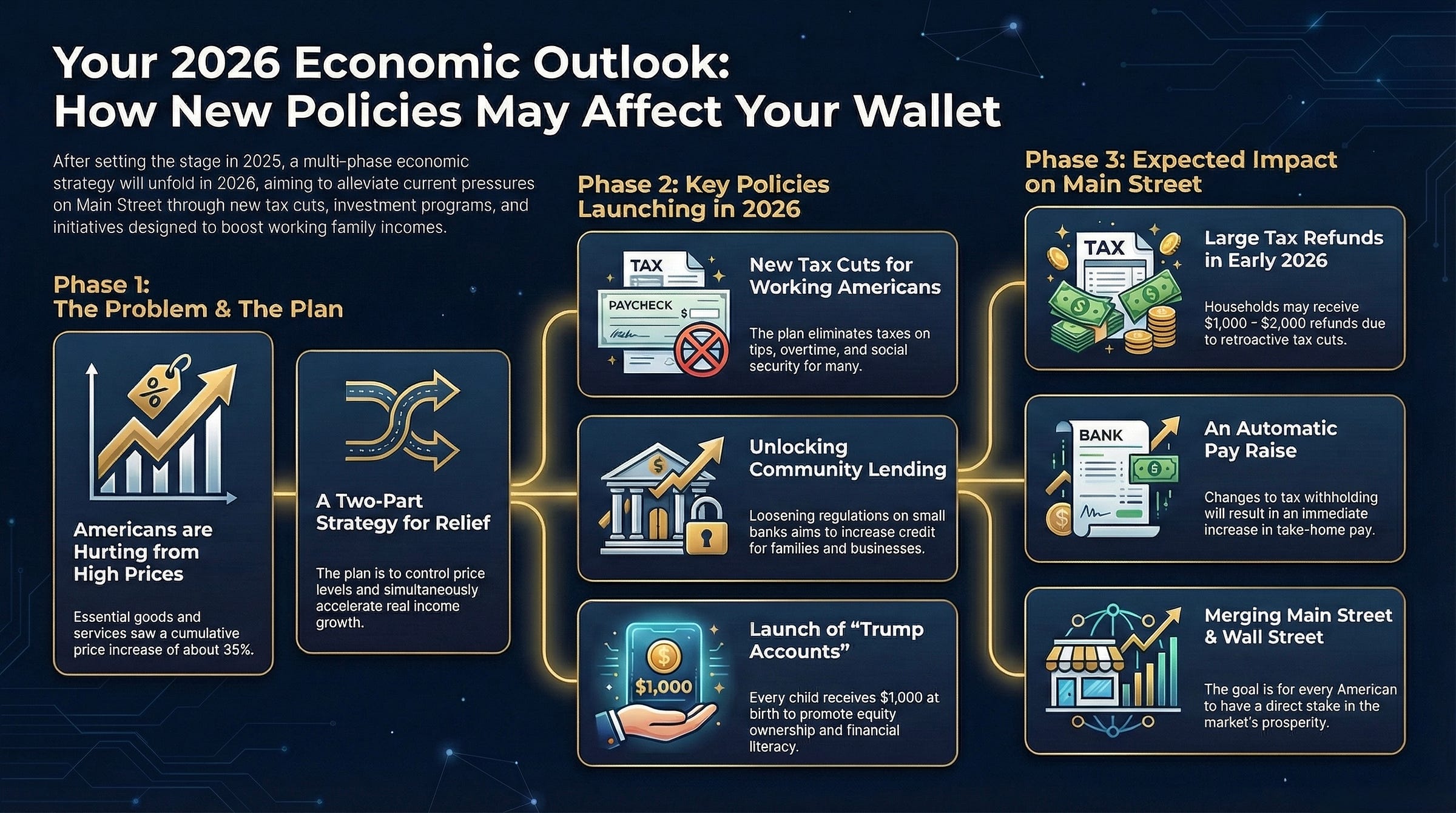

What does this mean for your portfolio? In short: The first half of 2026 is poised to be an explosive “risk-on” environment. The primary driver is a massive fiscal injection we’re calling the “Big Beautiful Stimulus.” According to Treasury Secretary Scott Bessent’s interview at the All In Podcast, American households are set to receive up to $2,000 in retroactive tax refunds starting in March. This, combined with the 250th anniversary of the United States and the incoming consumer spending flush due to FIFA World Cup being hosted in USA in June, 2026, we are going to experience a “spending boom” that the markets are already beginning to price in. However, we must balance this bullishness with a cautious eye on the crypto complex, which is undergoing a “Mafia Takeover” by Wall Street with the institutional order-flow inflows being taken over by Blackrock’s IBIT ETF. As capital rotates from MSTR to IBIT, Bitcoin is facing a temporary deleveraging event that could see it tag the $80,000 institutional gap before resuming its uptrend to catch up with it’s big brother NASDAQ Index which is the main “alpha.” which drives the Risk-on complex.

In the Realm of Equities: The AI revolution has shifted from a software story to a physical infrastructure story. Energy is now the primary bottleneck which is stalling the expansion of AI infrastructure. Data centers are desperate for power, leading to a massive demand for companies like Bloom Energy and GE Vernova which are willing to provide Giga-watt scale power supply within 6-12 month’s timeline as opposed to traditional power grid which is issuing wait times of 2-5 years to provide giga-watt scale power supply, thus leading to incredible demand for alternative energy sources as time is of the essence. We are also tracking a significant “catch-up trade” in Amazon, which has lagged the broader indices despite it being heavily involved in developing it’s AI Robotics arm which is eventually going to power it’s fulfillment sector within the next year, which is going to have a profound impact on company’s profit margins. This report details every major and minor catalyst, from the Nikkei-NASDAQ correlation to the deregulation of community banks and the energy companies which are feeling the AI infrastructure juggernaut, thus providing a comprehensive roadmap for navigating the Q1 2026 landscape. Are you prepared for the liquidity flood, or will you be caught in the deleveraging crossfire?