TLDR;

In the high-stakes arena of trading, the differentiator between consistent profitability and stagnant or declining accounts is often not the trading edge itself, but the execution. This deep dive explores the critical concept of Fat Tail Risk those outsized errors and massive losses that make trading expensive and sabotage long-term success. Based on extensive analysis, including historical brokerage data from the 90s covering over 10,000 accounts and the better part of 2 or 3 million different trades, a profound truth emerges: if you can cut just 10% to 15% of your worst trades, your profitability trajectory shifts dramatically. But how do you identify and eliminate these destructive behaviors? This post provides a comprehensive framework for understanding the psychological drivers behind these fat tails and offers actionable strategies to “attack the glitch” in your execution.

We introduce the “Dinosaur Analogy” to visualize trade distribution. Profitable traders operate in the “belly” of the dinosaur (the sweet spot of execution), while underperformers exhibit a “fat tail,” representing an excessive number of trades with massive negative outcomes. The root causes of these fat tails are deeply embedded psychological phenomena: Loss Aversion and FOMO (Fear of Missing Out). However, we challenge the conventional, surface-level understanding of FOMO. It is not merely about chasing entries; it is an overarching theme that dictates exits and trade management. Critically, loss aversion the tendency to cut winners short (e.g., exiting at a mere 5% profit rise) while letting losers run (e.g., holding a 10% drawdown) is itself a nuanced form of FOMO, driven by the fear of missing out on realized profits.

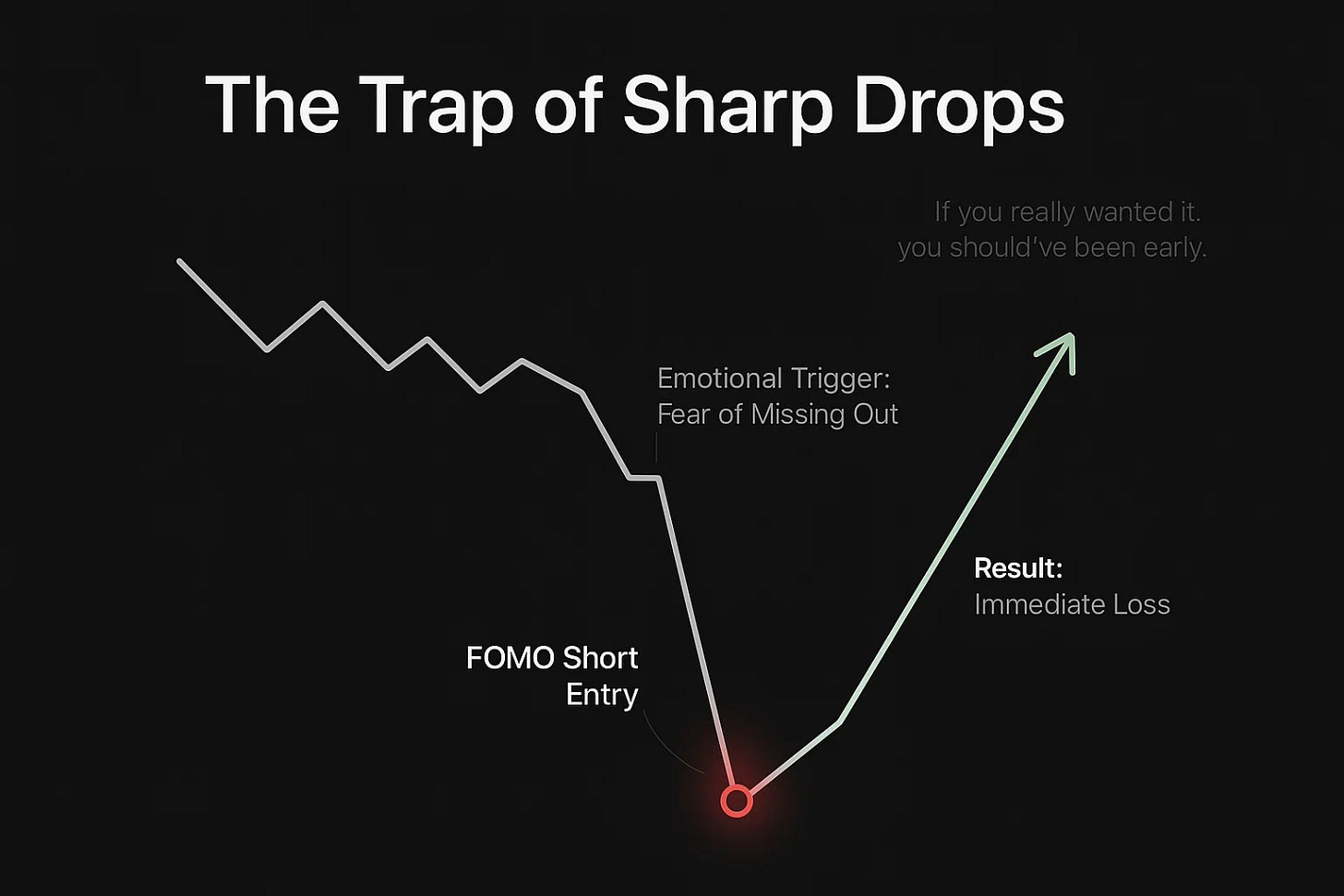

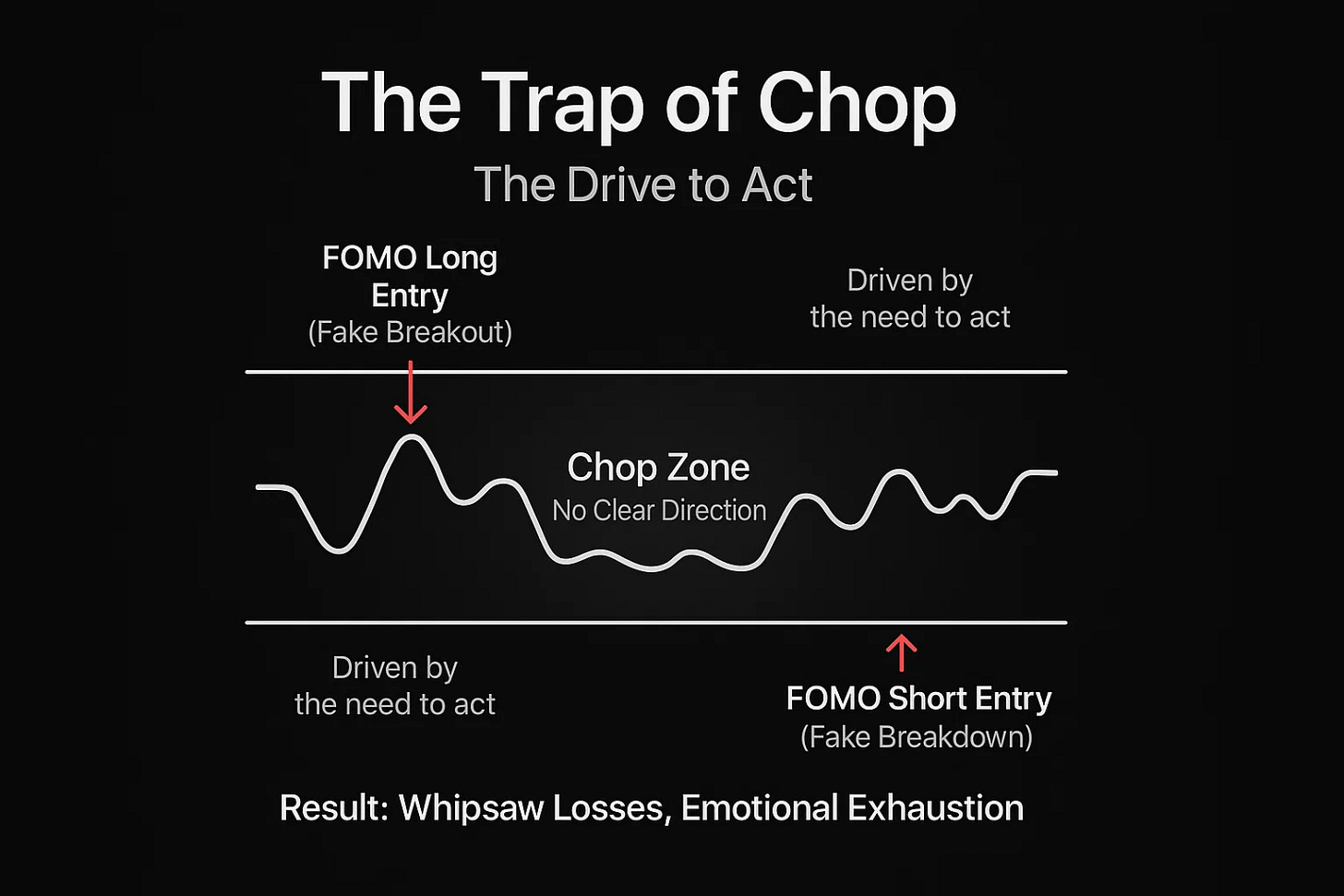

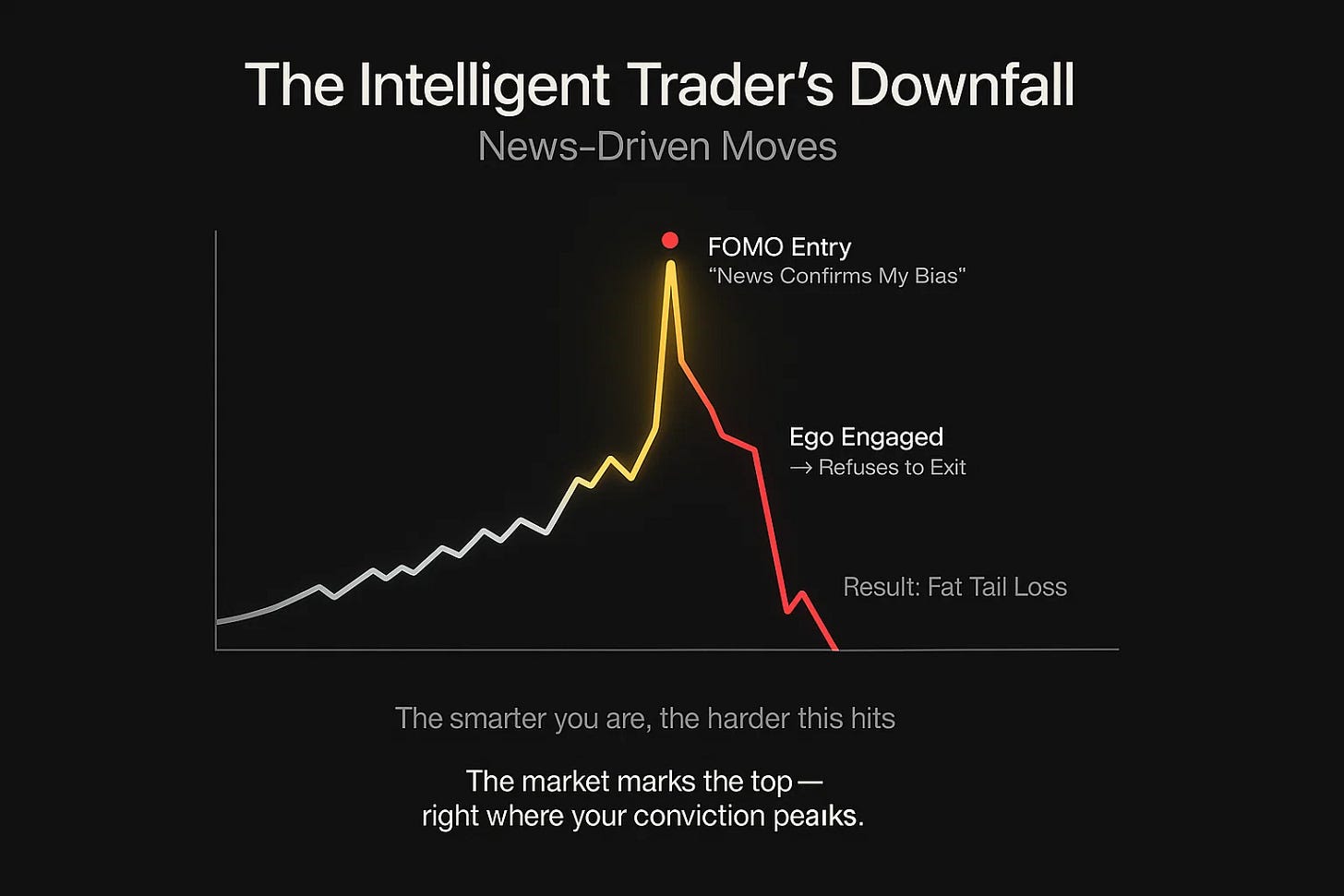

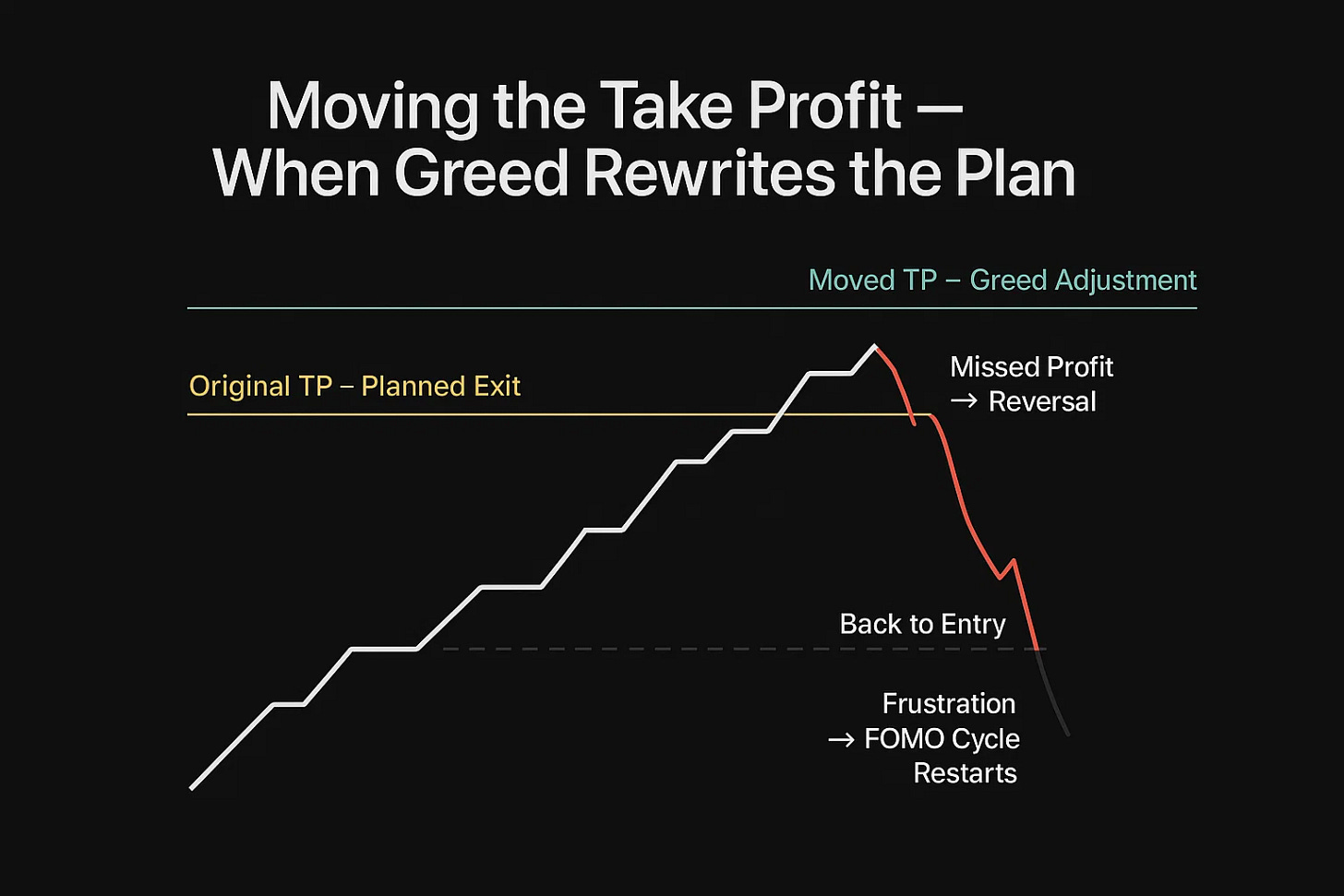

We identify the specific market environments that consistently trigger these psychological pitfalls: Sharp Drops, Consolidation (Chop), and News-Driven Moves. Recognizing these environments is the first defense against emotional decision-making. For instance, entering late during a sharp drop or forcing trades in choppy markets are classic FOMO behaviors. Furthermore, we explore the “intelligent trader’s trap,” where news events confirm a pre-existing bias, engaging the ego and leading to entries at the perfect top. We also examine how Greed, manifesting as moving take-profit levels, often results in unrealized gains turning into break-even trades, fueling further FOMO.

The solution proposed is counter-intuitive but effective: Do Nothing when these trigger environments appear. By resisting the urge to act during news spikes (like the recent 500 PIP move in USDJPY) or prolonged consolidations (like the 3-month range in EURUSD), traders can reduce their fat tail risk significantly potentially by up to 50%. We also cover essential and powerful technique for overcoming the “fear of being wrong”: using a simulator to rehearse a trade 10-15 times until the execution becomes automatic and the ego “shuts up.”

Key Takeaways from the presentation:

The 10-15% Rule: Eliminating your worst 10-15% of trades (the fat tail) is the most impactful adjustment for improving profitability.

Nuanced FOMO: FOMO affects exits and management, not just entries. Loss aversion is a critical subcategory of FOMO.

The Three Triggers: Be hyper-aware of Sharp Drops, Consolidation, and News-Driven Moves as high-risk environments for emotional trading.

The Power of Inaction: The primary strategy to reduce fat tails is to resist engagement in these trigger environments.

Overcoming Fear: Use simulation rehearsal (10-15 repetitions) to bypass the ego and execute trades automatically.

If you’re finding value in our research, we’d like to extend a personal invitation to explore the next level of market analysis within our Speculators Trading community. Our Discord server is a collaborative space dedicated to helping traders optimize capital allocation. Inside, you’ll gain access to our real-time Trading-floor commentary, high-conviction technical setups, proprietary educational resources, and strategic bi-weekly livestreams. We invite you to experience these premium resources firsthand and see how they can enhance your portfolio management. Join us with a 14-day free trial (120 USD/month after trial is over), you can cancel anytime, but we would love for you to stay.

Understanding Fat Tail Risk: The Dinosaur Analogy

The essence of successful trading execution lies in understanding the probability distribution of outcomes when applying a trading edge. The goal is to maximize positive outcomes while minimizing the impact of outsized errors, known as Fat Tail Risk. While institutions utilize complex programs and concepts like Value at Risk (VaR) to analyze this, when stripped back to the essence, it is about managing the distribution of outcomes.

The Sweet Spot vs. The Tail

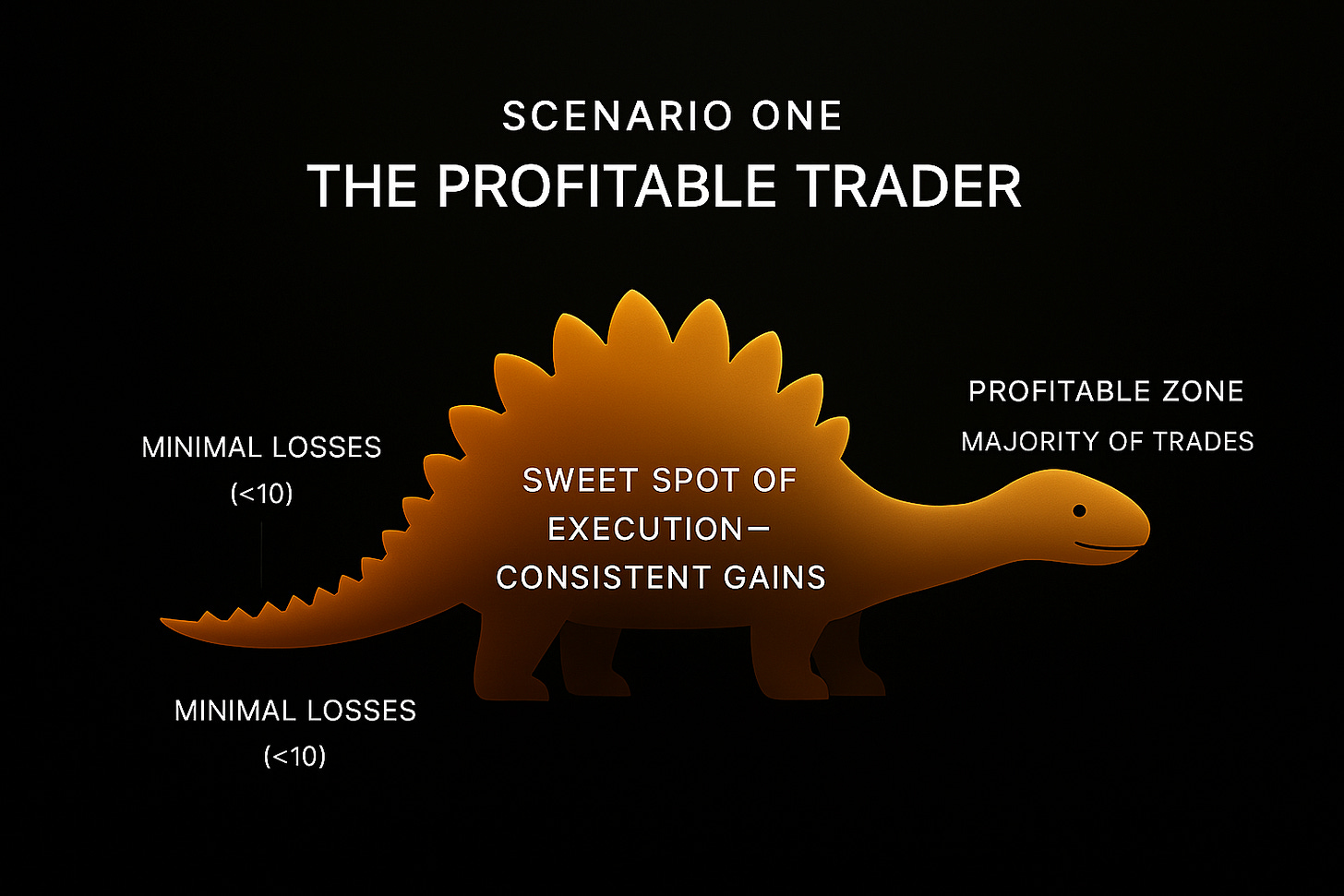

To visualize this, imagine the distribution of your trades along the shape of a dinosaur. The “sweet spot” of your execution is where the dinosaur is “at its fullest and at its best” the belly. You want the majority of your trades, in terms of standard deviations, to be accumulated along this part of the curve or towards the right.

Scenario One (The Profitable Trader): In this ideal distribution, the majority of trades are clustered on the upside, to the right-hand side of the curve. The “tail” on the left side, representing losses, is near to zero. A few trades in the tail are acceptable, but the bulk must be in the profit zone with losses greatly contained to under 1 standard deviation both in size and quantity. This is where you should be.

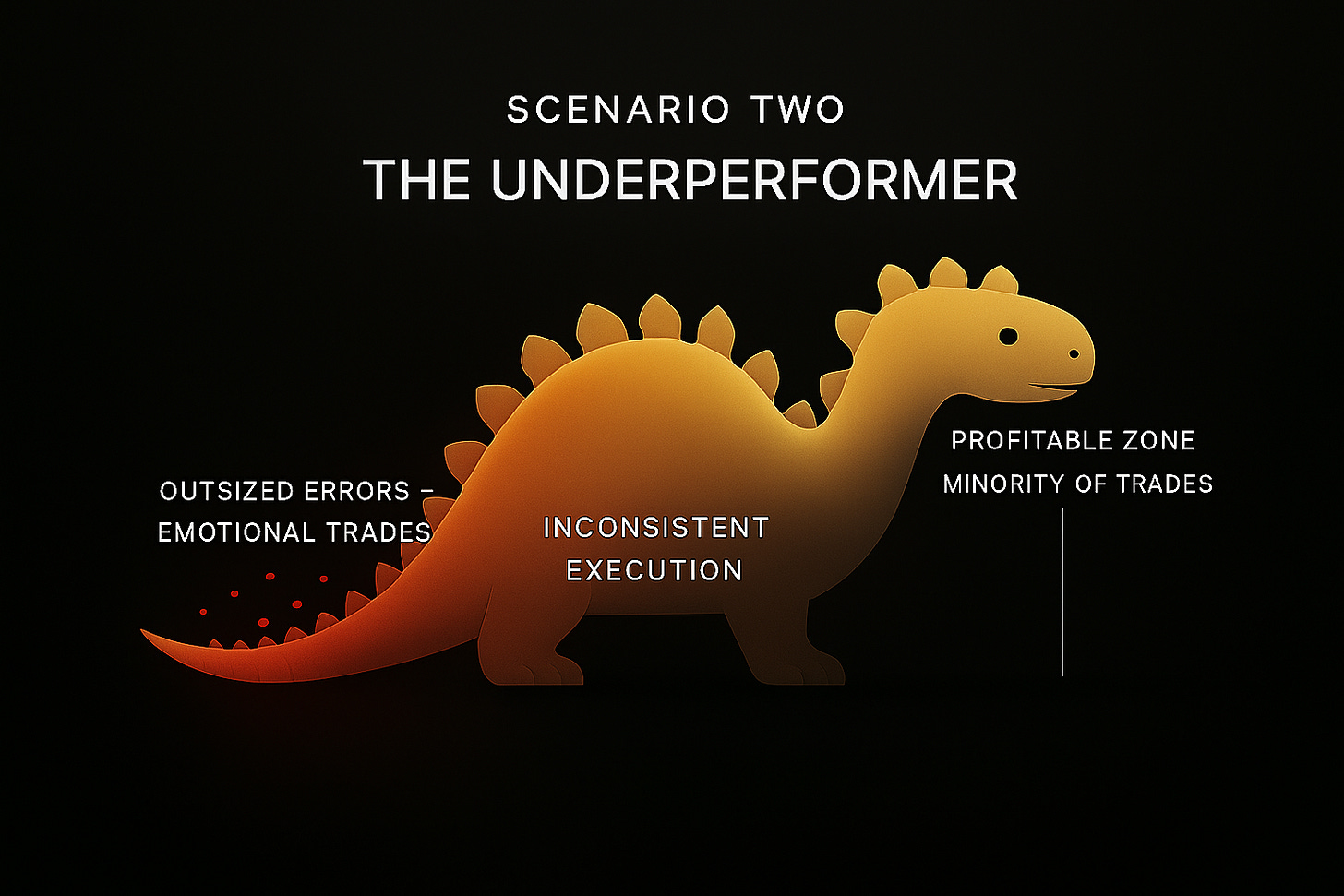

Scenario Two (The Underperformer): Unprofitable periods or unprofitable traders exhibit a different pattern. That same dinosaur has a “ fat left tail.” This fat tail is costing loads of money and makes trading very expensive. In this distribution, there are “way too many trades” in the tail areas. You don’t want to be in the tail.

The Impact on P&L Trajectory: The 10-15% Rule

The impact of reducing fat tails is profound and supported by extensive data. Drawing on analysis from various sources, including brokerage analysis from the 90s covering over 10,000 retail accounts and the better part of 2 or 3 million different trades, a consistent truth holds true:

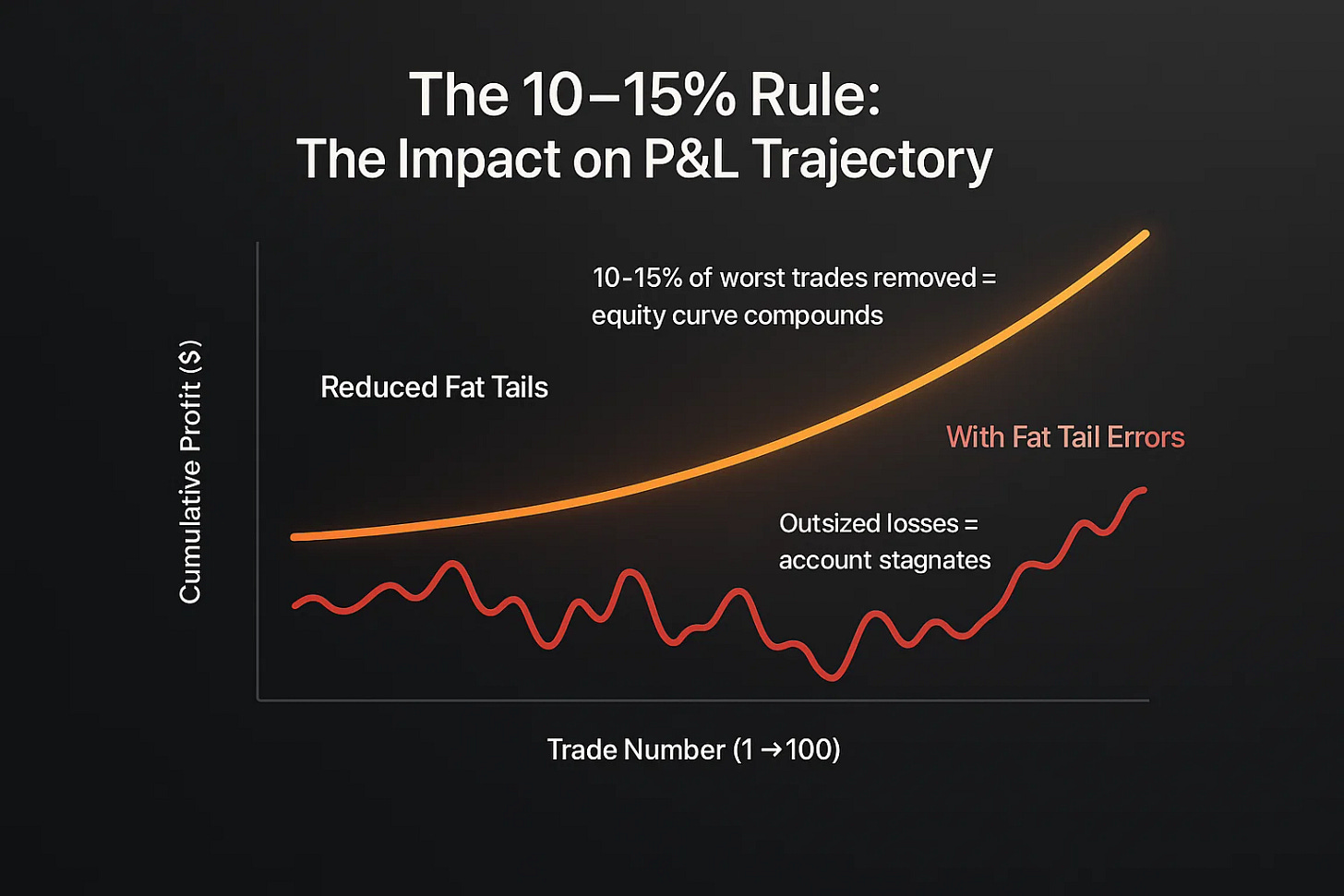

If you can cut 10% to 15% of your worst trades (your fat tail), your probability outcome moves into the upper zone. By totally reducing these massive errors, the trajectory of your trading account changes significantly.

Imagine charting your trading account on an X and Y axis, where X is the trade number (1 to 100) and Y is the profit (e.g., 10K, 50K, 100K).

The Orange Line (Reduced Fat Tails): When you reduce your fat tails, the equity curve moves steadily upward. This is where you want to be.

The Red Line (Outsized Errors): If those fat tails are not removed, the trajectory has a very similar pattern but is characterized by annoying drawdowns. This account “never moves anywhere fast” and often moves quite down as well. This is what happens when you have those outsized errors.

Now that we know what fat tail risk is and that correcting it will substantially increase profitability, the focus shifts to identifying why these tails happen. While every trader might say, “if I knew it was going to be a losing trade, I wouldn’t have been taking it,” there are identifiable preconditions to those really worst trades.

The Root Causes of Fat Tails: Deconstructing FOMO and Loss Aversion

To eliminate the fat tail and stay in the belly of the dinosaur, we must address the psychological drivers that lead to outsized errors. The most significant factors are Loss Aversion and a nuanced understanding of FOMO. Once you know they exist and where they exist in your P&L, it is much easier to identify that “bad Apple” and get rid of it.

Loss Aversion: The Groundest Cause

One of the most fundamental causes of fat tails is Loss Aversion (LA). This phenomenon dictates how traders react disproportionately to winning and losing positions.

In a Winning Position: The fear of losing the accumulated profit the fear that the profits will snap back is so big that a trader might cut the trade very early, perhaps after only a 5% profit rise.

In a Losing Position: Conversely, if in a losing trade, the trader might be down 10% or so but remains hopeful and will hold on.

Loss aversion makes sure that the winners are really, really small, and it makes sure that your losses can bleed quite a lot before sanity kicks back in. In the probability distribution, loss aversion lives squarely in the fat tail.

“Loss aversion will make you move stop loss. Loss aversion will make you exit a position earlier. Does all the bad things.”

The Nuances of FOMO (Fear of Missing Out)

The term FOMO is often overused and misunderstood. While many associate FOMO solely with the fear of missing out on entering a trade, this is a very surface-level understanding. At a deeper level, FOMO is an overarching theme that shows up very differently for different people and is highly nuanced.

FOMO is not just about entry; it’s about exit and trade management.

Believe it or not, Loss Aversion is a version of FOMO.

FOMO and Exiting Winners: When a trade goes up into profit (e.g., 5%), the fear of missing out of profits kicks in. This FOMO, manifesting as loss aversion, makes you exit the trade prematurely. “So FOMO isn’t only always about entering a trade, sometimes it’s actually exiting a trade, because you fear of missing out of profits.”

FOMO and Managing Losers: FOMO will also make you bleed out losers. This happens because you fear missing out that market will go back up into profit, making your losses disappear.

See how nuanced it suddenly becomes? Trading is all in the details. There is no single big change that transforms someone into a trading superstar; rather, it is small, tiny changes that create a ripple effect everywhere else.

Identifying the “Glitch”: Where FOMO Shows Up in the Market

FOMO, the driver of the fat tail, seems to be showing up consistently in the same places in market behavior. This is good news, as it means we can identify the “glitch” and attack it. We will explore the three primary environments where FOMO manifests: Sharp Drops, Consolidation, and News-Driven Moves.

The Trap of Sharp Drops

One primary way FOMO shows up is during sharp drops in the market.

The Scenario:

It’s a trading day, and the market has been moving up a bit and down a bit. Suddenly, it drops aggressively. You think, “Oh my god, is this going down and I’m missing out?” FOMO makes you go short near the bottom. And then, almost as if perfectly aligned with your emotion, the market reverses and goes back up.

The Error:

This is an emotional trigger. If you really wanted to trade this move, where were you earlier? “Why would you, for on God’s earth, enter on the third dive down?” when all the supports are broken and the bearishness is pretty much played out. This is a purely FOMO-driven entry, born out of sharp drops.

When you see a sharp drop, you should immediately ask yourself: Is this FOMO’s “little cousin”? The amount of money lost from these types of entries is massive.

Consolidation (Chop): The Drive to Act

The worst type of FOMO occurs within consolidation patterns (Chop). While sharp drops are quick you get in, realize you’re wrong, and bleed out quickly, usually within hours or days consolidation is more insidious.

The Scenario:

The market is moving sideways. You think you have figured it out: “This is ready to break out.” You analyze the chart, perhaps noting it took out recent lows and has equal highs. It looks like money. You enter within the range, and the market does something totally different and unexpected, perhaps faking a move before tanking.

The Error:

Why enter prematurely? Why not wait until it actually breaks out and then make a decision? Entering in a consolidation and choppy mode because of things you convinced yourself should happen is another version of FOMO.

What chop essentially does is drive people to act when there is no reason to enter. People go long at the highs and lose; people go short at the lows and lose. The market is driving liquidity and creating trauma for participants. You cannot afford to be there, as this is a significant contributor to the fat tail.

News-Driven Moves: The Intelligent Trader’s Downfall

This trigger is the worst because it consistently hits intelligent people. The smarter you are, or the smarter you think you are, the more likely you are to get hit by news-driven moves.

The Scenario:

The market has been trending, and then a massive move occurs on the back of news. The news hits, driving a breakout. Intelligent traders say, “Well, I was bullish all along. I knew this was going on. Now this news is confirming it.” They enter near the top of the spike.

The Error:

Because their ego and intelligence are now engaged, there is no chance they will get out of this position easily. But the market often marks the perfect top and absolutely washes them out, creating a massive fat tail loss.

Why did the entry occur there?

Bias Confirmation: You were bullish all along but never entered.

Emotional Trigger: News came out in your favor, pushing the market further and pressing the painful emotion of not being long to the max, prompting you to act.

Ego Engagement: You went long, your ego was behind the decision. When it drops, the ego deflects blame (e.g., “the news was stupid”), rather than accepting responsibility.

This is the pattern that catches out the smartest traders those who seemingly always do well but then suddenly blow up. It is, again, a manifestation of FOMO.

FOMO Triggers

Sharp Drops

Behavior: Entering short at the bottom of a fast, extended downward move.

Emotion: Fear of missing the move.

Outcome: Market reverses, immediate loss.

Consolidation

Behavior: Entering prematurely in a choppy market before a confirmed breakout.

Emotion: Urge to act, self-convincing about market direction.

Outcome: Whipsaw action, stopped out.

News-Driven Moves

Behavior: Chasing a breakout fueled by news, entering at the extreme.

Emotion: Ego and confirmation bias (“I knew it all along”).

Outcome: Entry near perfect top or bottom, sharp reversal follows.

The Role of Greed in Execution Errors

While the focus has been on FOMO and Loss Aversion, Greed is also a significant part of the fat tail problem. Assuming a trader has a consistent edge proven strategies exist that catch massive trends (e.g., Trades we have been showing and executing in Speculators-Trading Discord channel) the problem is often not the edge. The problem is the execution and reducing those 10-15% worst trades.

Moving the Take Profit

Greed often manifests in how traders manage their take-profit (TP) levels.

The Scenario:

You enter a trade, and the market moves favorably, approaching your original take-profit level. Seeing the strength of the move, you think, “Oh man. I didn’t make enough money out of this move.” You decide to move your take profit higher. The market comes close to the new target but then reverses. You then hope it will at least return to your original take-profit level, but it continues to drop even further.

The Consequence:

Instead of taking the profit as planned, the opportunity is lost. You moved your TP, never got the higher price, and missed the original exit. The trade eventually returns to break-even, meaning you made no money. This experience leaves the trader frustrated and will push you straight into another FOMO trade.

The fat tail makes you lose out on winners and can make you double down on losers. It is a bad thing, and we need to attack the glitch.

Attacking the Glitch: Strategies to Reduce Fat Tails

Now that we have identified the behaviors and the environments that drive bad trading, we can implement strategies to address them. Just a small adjustment will massively increase gains.

The Power of Doing Nothing

The strategy going forward is straightforward but requires discipline. Every time you identify one of the high-risk FOMO environments, you need to start doing something different.

The first thing is: You don’t do anything.

You don’t do anything when you see a sharp drop.

You don’t do anything when you see a consolidation.

You don’t do anything when you see a news-driven market.

When you review your trading history, it is highly probable (over 90%) that your big winners were never in any of those categories. They were always a different type of trade.

When you see these three types of environments, it is your cue not to do anything. Take a step back, analyze twice, analyze thrice. You must perform really deep, strong analysis to decide whether to trade in this environment or leave it.

Once you make the decision to leave an environment if you decide it is news-driven and you are not part of it you stop looking at chasing it and side step the left tail. This is where the fat tail losses are going to die. Implementing this discipline will reduce your fat tails significantly potentially by 50%, far exceeding the 10-15% threshold needed to dramatically change your account trajectory.

Live Market Examples

Applying this strategy to live market examples provides clarity on how to avoid fat tail events in real-time. In our trading community bi weekly livestreams, recorded for later access, we squash the left tail. Key to this is understanding the market environment fully and sharing this with all members. This knowledge and skill is then transfered to all members in the community, who then pass it on even further, and that’s when the wealth effect kicks in.

Managing Positions and Avoiding Fat Tails: A Bitcoin Case Study

Q (Tinker): If a trade reversed, would you cut the trade instead of taking a full R loss? When you say to avoid 10-15% trades, are you referring to limiting taking full R losses?

No, forget “1R loss” this is “day trader lingo” and doesn’t make a difference in this context. You can take 1R losses. Reducing the 10-15% worst trades means avoiding entries based on the high-risk environments discussed: when FOMO, loss aversion, or greed kicks in. Those generate your worst losses.

Bitcoin Example:

A long position was initiated on a specific candle. The market went up, then came back down, and the trade was exited at break-even.

Reasoning: The environment was wrong; it was a consolidative environment heading into quarter-end, implying volatility. The trade was cut because the market didn’t pick its direction or wasn’t ready to. We are speculating and have no idea what the market will do.

Outcome: If the trade had not been cut, it could have turned into a fat tail by running all the way down to the stop loss. The position was re-entered later (Sunday/Monday morning) when it came back into the desired levels, entering around 112K with a stop fairly tight under the 108K level, which then panned out neatly.

It is crucial to know where you are. If you are in any of those high-risk environments, choose not to act, or at least be cognizant that you are potentially in a fat tail risk event. Sidestepping those fat-tail events allows better opportunities to keep showing up. And remember you only need to reduce your fat tail by 10-15% to see exponential growth, at an accalerated pace.

Key Takeaways and Outlook

The path to consistent profitability hinges on mastering execution and minimizing Fat Tail Risk. By understanding that just 10-15% of your worst trades significantly hinder your account growth, you can focus on eliminating these outsized errors. The key is recognizing the psychological drivers Loss Aversion and the nuanced forms of FOMO and the specific market environments where they thrive.

Identify the Fat Tail: Use the “dinosaur analogy” to visualize your trade distribution. Aim for the belly, not the tail.

Understand FOMO’s Nuance: Recognize that FOMO affects exits and management, not just entries. Loss aversion is a form of FOMO (fear of missing out on profits).

Recognize the Triggers: Be hyper-aware of Sharp Drops, Consolidation (Chop), and News-Driven Moves. These are the breeding grounds for emotional decisions and fat tail losses.

Attack the Glitch: The primary strategy in these environments is to do nothing. Sidestepping these setups will dramatically improve your P&L.

Overcome Fear: Use the simulator rehearsal method (10-15 repetitions) to overcome the fear of being wrong and train yourself to execute mechanically.

If you’re finding value in our research, we’d like to extend a personal invitation to explore the next level of market analysis within our Speculators Trading community. Our Discord server is a collaborative space dedicated to helping traders optimize capital allocation. Inside, you’ll gain access to our real-time Trading-floor commentary, high-conviction technical setups, proprietary educational resources, and strategic bi-weekly livestreams. We invite you to experience these premium resources firsthand and see how they can enhance your portfolio management. Join us with a 14-day free trial (120 USD/month after trial is over), you can cancel anytime, but we would love for you to stay.