The Dollar Smile Theory

The simplest framework for understanding why the dollar goes up when everything’s great… AND when everything’s terrible. Here’s where we sit today.

The Theory in 30 Seconds

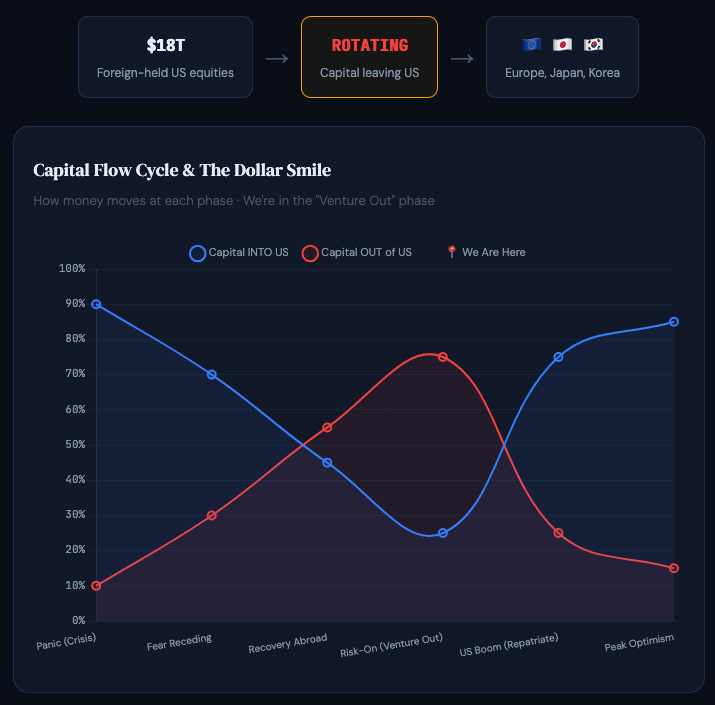

Imagine drawing a smiley face. That’s how the US dollar behaves across the economic cycle. The dollar gets strong at both ends of the curve when things are really bad (left side) or really good (right side). It gets weak in the middle when things are just… meh.

Stephen Jen, a former IMF economist, cooked up this idea in 2001. Over 20 years later, it’s still the single best mental model for the dollar. But there’s a twist in 2025–2026 that’s breaking the pattern.

The Dollar Smile Confidence Metric

I’ve built a composite score using 6 real-world indicators to triangulate where we actually sit on the smile right now. Each input scores from 0 (deep left/panic) to 100 (far right/boom). The middle zone = 40–60.

How to read this

0–30 = Deep panic (left of smile, dollar strong from fear). 30–60 = Middle zone (dollar weak, everyone looking elsewhere). 60–100 = Boom zone (dollar strong from US outperformance). We’re at 42 solidly in the weak-dollar middle, but with some panic risk underneath.

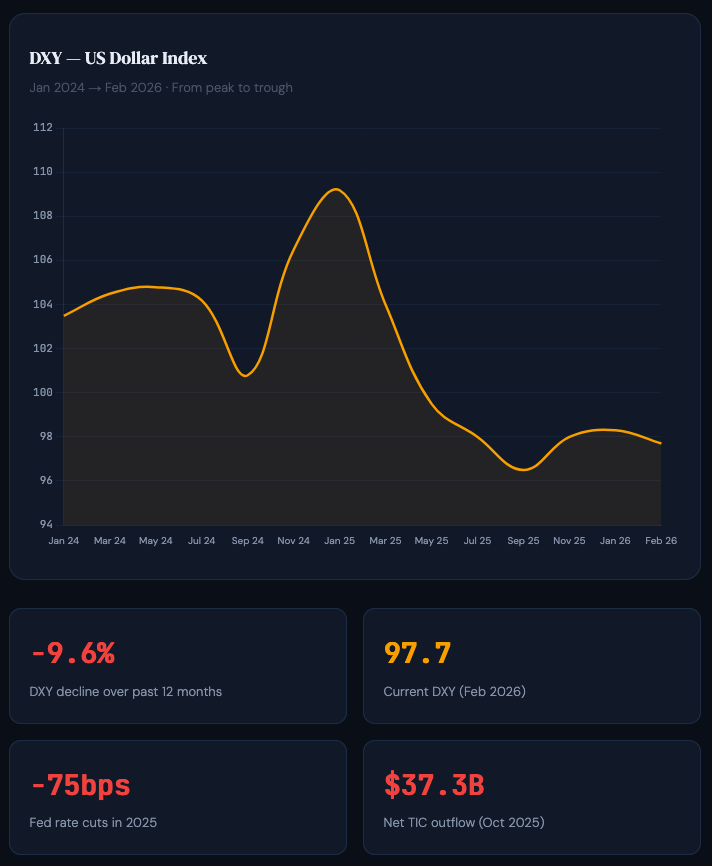

The Dollar’s 2025 Cliff Dive

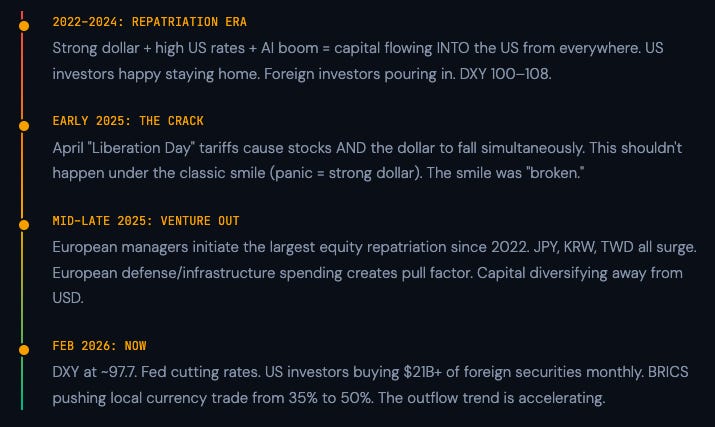

The DXY (Dollar Index) tells the story better than any words. We went from 109+ in January 2025 to ~97.7 today. That’s roughly a 10% decline in 12 months. For the world’s reserve currency, that’s enormous.

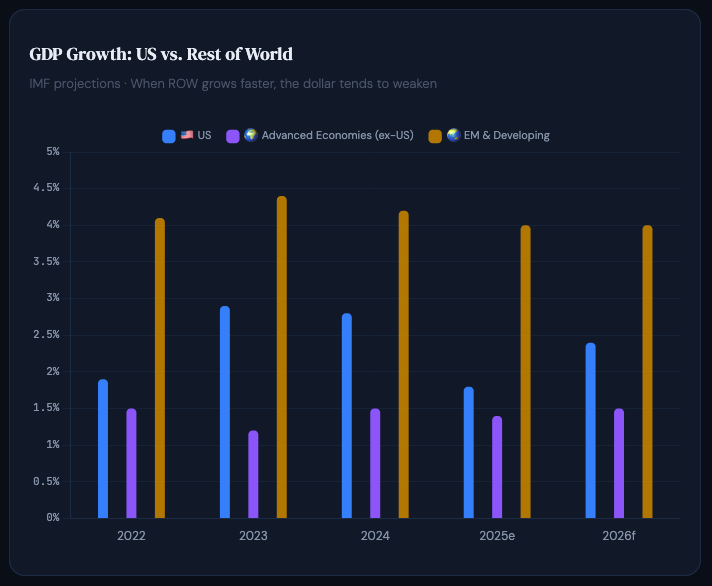

US Growth vs. The Rest of the World

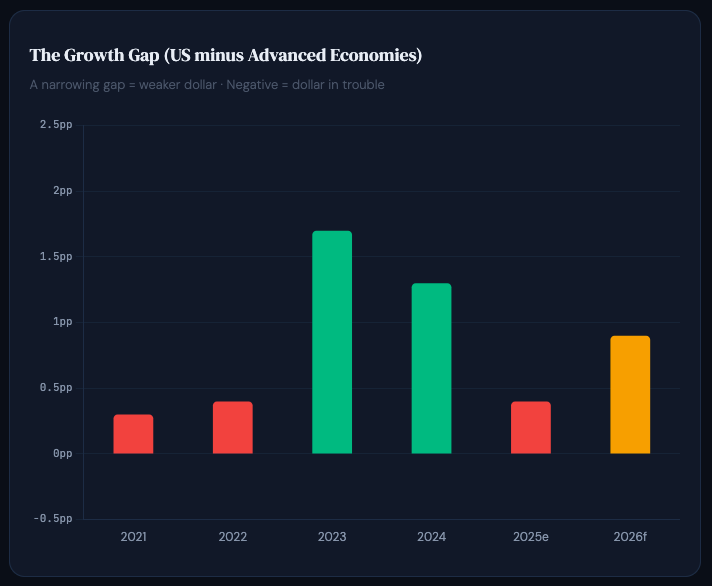

This is the engine room of the Dollar Smile. When the US grows faster than everyone else, the dollar strengthens (right side of the smile). When the gap narrows or reverses, the dollar weakens (middle zone).

Here’s the problem: the US growth advantage that powered the 2022–2024 dollar rally? It’s shrinking fast.

The Key Insight

In 2023, the US was growing at 2.9% while the Eurozone was at 0.4%. That massive gap = strong dollar. By 2026, the IMF sees the US at 2.4% and the Eurozone recovering to 1.5%. The gap is compressing. It’s not that the US is weak it’s that everyone else is catching up. That’s textbook middle-of-the-smile territory.

Follow the Money: Where Investors Are Going

This is where the rubber meets the road. The Dollar Smile isn’t just an academic theory it’s driven by actual money moving in and out of the US. And right now, the flows are shifting in a way we haven’t seen since 2010.

The Setup: $26 Trillion of Foreign-Owned US Assets

Over the past 15 years, foreign investors piled into US stocks and bonds to the tune of $26 trillion that’s 88% of US GDP. A lot of this money came in unhedged, meaning foreign investors made money both from US asset prices going up AND the dollar going up.

Now the dollar is falling, and those unhedged positions are bleeding. The smart money is starting to rotate.

When US Investors Venture Out vs. Repatriate

There are two sides to this coin. Foreign investors are pulling back from the US. But US investors are also looking abroad for better returns they increased holdings of foreign securities by $21.4 billion in October 2025 alone.

5 Things Most People Miss

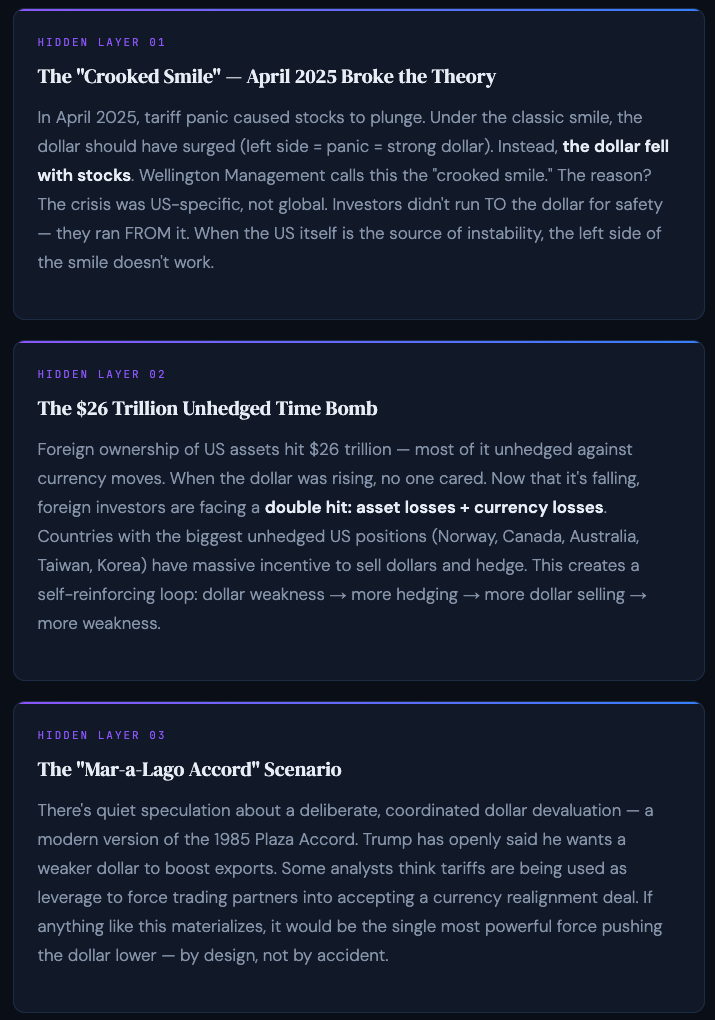

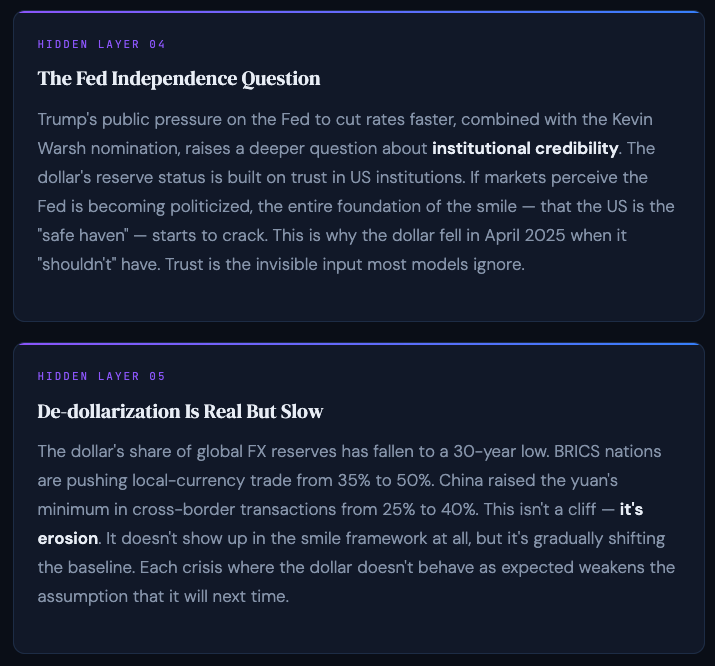

The Dollar Smile is a great starting point. But there are deeper layers most analysts skip over. Here are the hidden dynamics that could reshape where the dollar goes next.

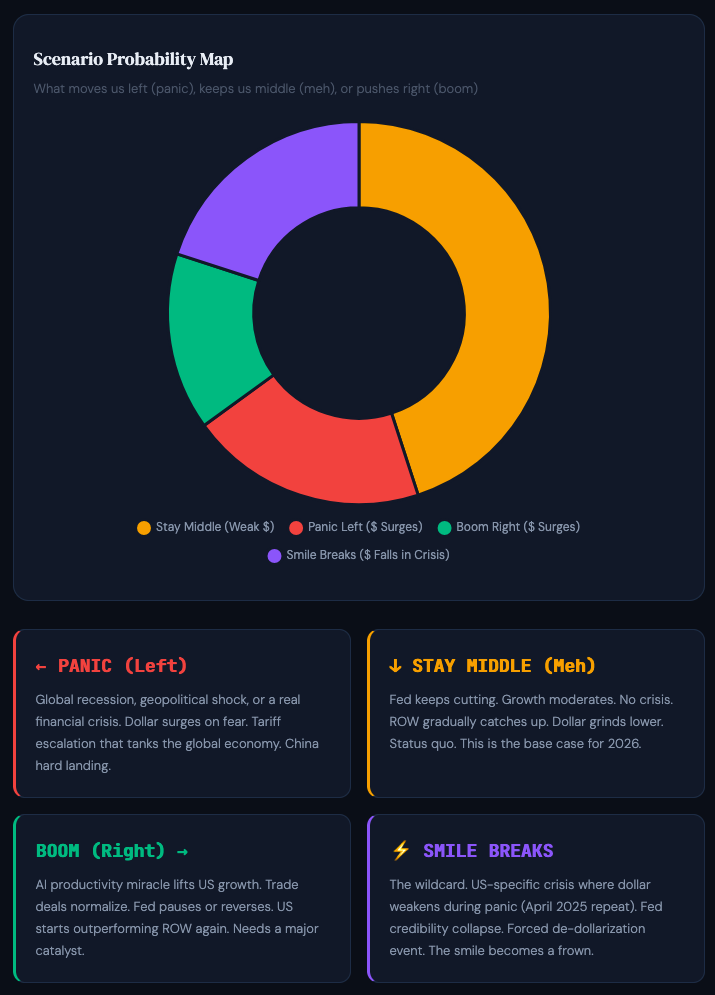

What Could Flip Us to Another Phase?

The Bottom Line

We’re sitting in the weak-dollar middle of the smile, with a composite score of 42/100. The growth gap between the US and everyone else is narrowing. Capital is flowing out. The Fed is cutting. And for the first time in a decade, the smile itself might be changing shape the “safe haven” assumption that powers the left side is under pressure. The base case for 2026: a weaker dollar with downside bias, interrupted by occasional fear-driven bounces.

Key takeaways:

Composite Score: 42/100 we’re squarely in the weak-dollar middle zone, tilting slightly toward panic. Built from 6 inputs (US vs ROW growth, Fed direction, VIX, capital flows, institutional trust, de-dollarization pressure).

The “Crooked Smile” April 2025 broke the classic framework when the dollar fell WITH stocks during tariff panic. When the US itself is the source of instability, the safe-haven bid evaporates. Wellington flagged this as a potential regime change.

$26T unhedged foreign-held US assets creating a self-reinforcing exit loop dollar weakness triggers hedging, which triggers more selling, which triggers more weakness.

The Mar-a-Lago Accord scenario, de-dollarization acceleration (BRICS pushing local currency trade from 35% to 50%), and the Fed independence question are all structural forces most smile analyses ignore entirely.

Warmest Regards

Miad