The Engram Edge: Make more Successful Financial Trades

Mastering the NAC vs. Insula Battle

Executive Summary

As we rapidly approach the last quarter of what has felt like “one of the fastest years ever,” this week’s analysis provides a critical two-part breakdown essential for navigating the current environment. We first dissect the often-misunderstood psychological edge utilized by professional traders the Engram Trading Edge and then pivot to a tactical market overview, analyzing liquidity flows, market fears, and where the next major moves are evolving across equities, Bitcoin, Gold, and the Forex market.

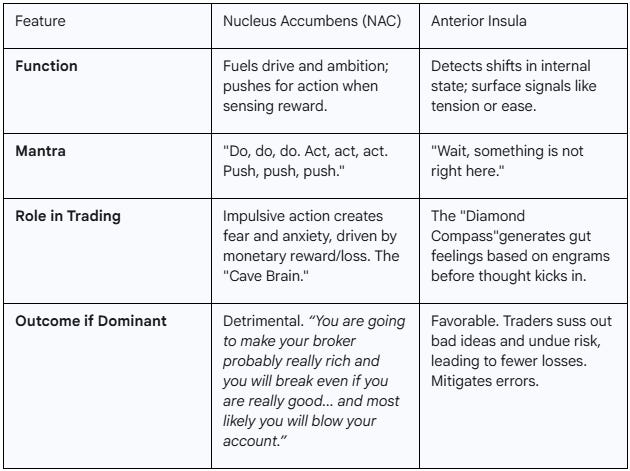

Do you ever find yourself hesitating on a perfect setup because something just feels off? That is likely an engram firing—a stored emotional cluster or memory trace. This isn't just intuition; it's a complex biological mechanism where your brain retrieves a cluster of past emotions, physical sensations (like temperature changes or reflexes), and consequences when a similar situation arises. This analysis delves deep into the neuroscience behind these moments, highlighting the internal tug-of-war between the Nucleus Accumbens (NAC) and the Anterior Insula. The NAC fuels ambition and the impulsive drive to act, seeking dopamine rewards and often leading to decisions driven by fear—a mechanism described as “terrible” and “hugely detrimental” to trading. In contrast, the Insula acts as a "diamond compass," detecting subtle internal shifts and surfacing that gut feeling before conscious thought kicks in. Learning to favor the Insula over the NAC is the difference between blowing your account and achieving consistent profitability by mitigating losses.

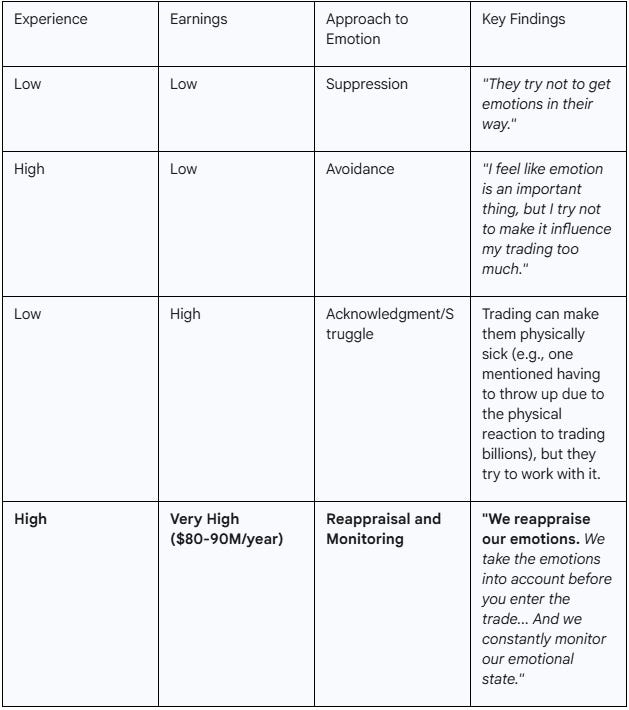

We explore practical methods to weaponize this intuition, emphasizing Emotional Replay Journaling documenting preconditions, real-time emotions, and outcomes immediately to counteract the brain's tendency to rationalize past mistakes. Developing a "somatic vocabulary" and implementing the crucial "60-second pause" to let emotional peaks subside are key strategies. Compelling evidence supports this approach, including a 2016 experiment focusing on "what not to do" (using a 5-6 page playbook of prohibitions) which generated significant P&L increases, with one participant making $80,000 from near nothing. Furthermore, a landmark study of 110 institutional traders in London revealed that the highest earners (making $80-90 million a year) do not suppress emotions; they actively reappraise and monitor their emotional states, confirming that wealth truly begins in the nervous system.

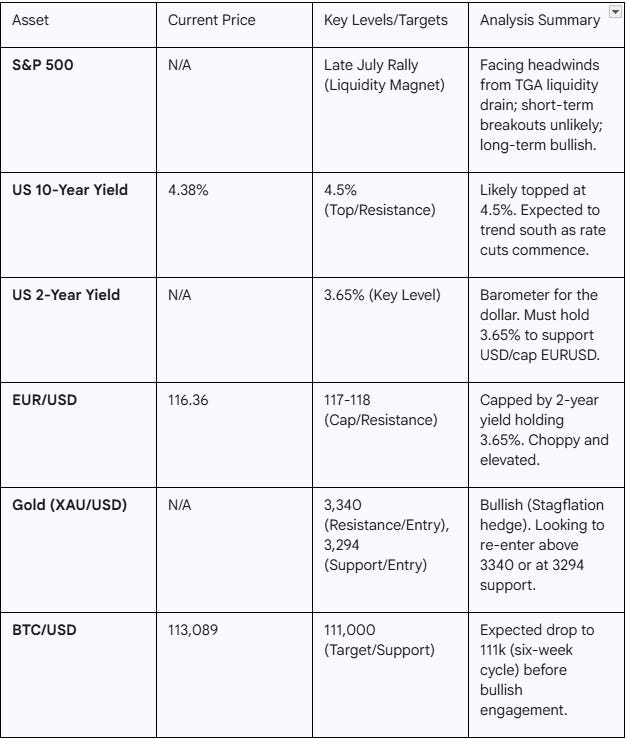

In the market analysis segment, the current landscape is characterized by significant chop as institutional traders remain on holiday until the last week of August, placing the market largely in observation mode. Liquidity is being drained by the TGA, impacting equities like the S&P 500, which is facing pullbacks due to shrinking margin accounts and an inefficient late-July rally acting as a "liquidity magnet." While long-term bullish, expecting immediate breakout rallies is deemed “fanciful.”

Key Market Outlooks:

Yields and Forex: The US 10-year yield likely topped at 4.5% (currently 4.38%) and is expected to move south, pressuring USDJPY. The 2-year yield holding above 3.65% is capping EURUSD advancr above the 1.17-1.18 levels (currently 1.1636).

Gold (XAUUSD): Remains a superior trade in the current stagflation environment (slowing growth, persistent inflation). Key re-entry levels are above 3,340 or a dip to the cycle low at 3,294.

Bitcoin (BTC): Currently trading at 113,089, a drop towards or below 111,000 is anticipated as part of a six-week cycle before a bullish turnaround is considered.

Catalysts: The upcoming Jackson Hole meeting (this week) and the September NFP data are crucial events, with Jackson Hole historically being a site of "mega reversals."

The Engram Trading Edge: Weaponizing Your Nervous System

The session opened with an extensive exploration of the "engram trading edge," detailing the mechanisms behind gut feelings and how professional traders utilize these internal signals for superior risk management. This is about understanding the neurobiological processes that differentiate highly skilled traders from those who merely possess the same tools.

Defining Engrams: The Science of Gut Feel

An engram is defined as a stored emotion, a cluster of stored emotion that is retrievable. If you think about your brain as a hard drive, it has different ways of saving information. Some information is saved linearly, like tape recording noise or visuals. Engrams, however, operate differently by pulling data from a vast amount of information sourced directly from the body.

This data includes subtle cues that the conscious brain often filters out as noise throughout the day:

Bodily sensations

Changes in temperature

Changes in mood

Changes in reflexes and thought patterns

Things that happen externally and internally

When an emotional reaction to an outcome in life creates a significant memory trace, this "thought cluster" is stored as an engram. The brain can store millions of these. While the average person cannot automatically tap into these engrams without training, they do exist and manifest as sensations. The body talks to the brain in very different ways, and learning to identify this communication is crucial.

The Moment Before It Clicks

Consider the moment before it clicks: A trader watches EUR/USD approach a level marked for weeks. The heart rate rises, the stomach tightens, and they hesitate. The chart looks perfect, but something feels off. “A lot of us can relate to that. We have been in situations where we had things planned but it just does not feel right.”

The trader may consciously think, “I’m not too sure about this and I have seen a setup before last time it failed.” They do not consciously remember the specifics, but their body does. This is the nervous system remembering the same trade the mind forgets. The prefrontal cortex or the nucleus accumbens, which constantly want to take action, do not have access to these deeper memory traces.

The initial reaction analysis is hesitation not fear, but a distinct feeling that perhaps the setup is not as good as initially thought. This memory shows up precisely when needed. You cannot plan for it. This ability to access and listen to these engrams when they show up is what differentiates the very skilled trader from the trader with the same tools but lacking the internal awareness.

The Neurobiology of Intuition: How Engrams Are Stored

The engram is a stored memory trace composed of not just facts, but emotion + sensations + the consequences that happened. In trading terms, it encodes what the chart looked like, how your body felt when you acted, and what the result was. This data is stored across huge parts of the brain, functioning like a team of internal "data scientists" gathering information for situational awareness and giving you a roadmap that is impossible to articulate consciously. “You literally could write two books about a single trade if you were to take in all the sensations.”

The key brain regions involved are:

The Hippocampus: Locks in the event details.

The Amygdala: Provides the emotional charge.

The Insula: Registers the physical sensations (e.g., sweaty palms, heart racing).

The Nucleus Accumbens (NAC): Provides the ultimate judgment was it worth it? Did you win or lose?

Visualizing Brain Functions

To better map out where these functions occur: visualizing the brain from the side (front to back), the Nucleus Accumbens is the yellow dot or region toward the front. This is the part activated when you want to take action and when it feels good. Deeply folded within is the Anterior Insula section, which takes in all the information where the engrams fire up and where internal work is done to understand the gut feeling.

The Internal Battle: Nucleus Accumbens (NAC) vs. Anterior Insula

The core of trading psychology lies in the internal tug-of-war between these two critical brain regions. Understanding their distinct roles using scientific terms to categorize what these different brain compartments do is essential for navigating trading decisions correctly.

The NAC: The Impulsive "Cave Brain"

The Nucleus Accumbens (NAC) fuels drive and ambition. It is likely the NAC that drives new traders to open their first account. It lights up when there is a potential reward and pushes you to act when it feels good. While beneficial for normal life, this mechanism is hugely detrimental to trading.

The NAC's job is constant action: “Do, do, do. Act, act, act. Push, push, push.” It is excellent for activities requiring continuous effort, like working out or playing football, but terrible for trading. The NAC must be heavily filtered, and engrams serve as that filtration mechanism.

Functionally, the NAC is the "cave brain." It says, "I am hungry, I am going to get food," or reacts to perceived threats. In modern life, the NAC activates in response to monetary rewards. If you are in a losing trade, the NAC activates, demanding an exit because loss of money equates to loss of status. It is the source of the entire fear and anxiety generated during trades, and it is unlikely to be in your favor if you act on it.

The Anterior Insula: The Diamond Compass

In contrast, the Anterior Insula is the favored tool for analysis and trading. It is the diamond compass. It detects shifts in the internal state and surfaces signals like tension, ease, and contraction, creating that gut feel before your thought kicks in.

When you listen to the Insula, you recognize, “Oh, I have seen this before. The likely outcome is going to be this.” At minimum, it signals that you should be paying attention. Action should only be taken by the NAC after the Insula has dissected what is going on internally.

The Conflict and Awareness

The conflict arises when a setup looks like a winner, triggering the NAC to say, “Let’s go, this is the moment,” while the Insula simultaneously says, “Wait, something is not right here.” Whoever wins this internal battle depends entirely on the trader's awareness.

Trading is fundamentally about mitigating errors, mitigating losses, and fostering better risk-taking. If a trader can improve their outcomes by utilizing this awareness—turning 5 losses out of 10 trades into three losses, five wins, and two break-evens—their operating system is significantly improved.

The Trader’s Decision Loop: A Millisecond Battle

The decision-making process in trading happens within milliseconds, forming the fastest loop ever. Understanding this loop is essential to capturing the fleeting emotions that guide action.

Engram Activation: A chart pattern emerges and activates an engram (the internal data scientists pulling millions and billions of data points to present a similar past situation).

Sensation Response: The body responds with sensations (the only way it can communicate). The Insula picks up on tension, ease, a heavy chest, jaw clenching, or a boiling forehead.

NAC Injection: The NAC injects dopamine: “This could be it. Let's trade. Let's risk more. I am feeling this is it.” Crucially, when people say they are "feeling it," it is often just the NAC firing dopamine, compelling them to act, not a true intuitive feeling.

PFC Rationalization: The Prefrontal Cortex (PFC) rationalizes the impulse, creating a justification for why the trader should take the action. Now, both the NAC and the rational brain are aligned on a potentially stupid idea (high danger zone).

Action: The trader clicks or holds back.

New Engram Creation: If they take a trade that their body signaled against (like the EUR/USD example), rationalized it, and lost, a new engram is created, often leading to self-blame because the process happened too fast to intercept consciously.

Interrupting the Loop: The Role of Self-Respect

Top traders inject more internal work and Anterior Insula pattern recognition into this loop. They describe moments where they “just knew” they had to size down, skip the trade, or go all in based on what the body said.

A specific example cited was Trader Pheneck, who had built up an awesome Dow Jones short idea. He spoke about it for hours. When the price arrived, he stated, “My gut feel says it is a no.” It takes significant self-awareness and self-respect to publicly back away from a trade idea discussed at length. By sticking true to what his body was telling him that the momentum was on the other side he avoided a loss, which is infinitely more important than forcing a trade. It is vital to differentiate when the engram is firing off as information versus when the NAC is simply fearful of losing money.

Cultivating Awareness and Building Your Edge

Awareness does not just show up; it is a process developed through dedicated practice. To consistently build the engram edge, traders must focus on specific techniques to capture and interpret their internal signals.

The Power of "Don'ts": The 2016 Awareness Experiment

A historical side story illustrates the practical implementation of awareness training. Observing why many traders fail despite learning from successful professionals led to a realization: if you give people a roadmap of what to do, the NAC will hijack the process 90% of the time because it is wired to preserve capital. Retrospective analysis often fails to reveal the exact reasons for actions taken unless they are written down in real-time.

This led to a new hypothesis: instead of telling new traders what to do, telling them what not to do might yield better success.

The 2016 Test

A test was conducted back in 2016 with about 60 people (initially aiming for 100-200). Instead of a standard one-page trading plan (e.g., risk half a percent, max 5% loss per week), these traders were given a playbook of "don'ts" that was five or six pages long. This playbook included criteria based on past losses, market conditions (e.g., you are not allowed to trade if X, Y, and Z is present), and self-awareness questions. Before taking a trade, traders had to go page by page to ensure none of the negative conditions were present, forcing an environment of self-awareness.

The Results

The experiment lasted about 12 weeks. While not everyone had the time or mentality to connect the dots on how this would change their life in trading, seven (or six) participants did stick with it. Their P&L increased significantly.

One trader, who had never made money trading, ended up $80,000 by the end of the program.

Others did well but returned to their entrepreneurial day jobs.

Two participants eventually started their own trading courses, now visible on YouTube.

This underscores that awareness is not given; it is a process that requires commitment and clear-mindedness.

Emotional Replay Journaling: Capturing the Truth

The most critical tool for training the engram part of trading, the epitome of trading where the question shifts from if you will make money to how much you will make is Emotional Replay Journaling.

As noted in the book Clear Thinking, when we think back to an event retrospectively, the brain often rationalizes what happened and masks the real truth or micro-nuances to protect us from feeling stupid or vulnerable. To overcome this, journaling must be done immediately, covering:

Preconditions: How did you feel and what was going on in your head before entering the trade? How did you evaluate the idea? Did you feel it was a good/bad setup?

During the Trade: What influenced your decisions (e.g., a candle wicked, external news)? How did you execute?

Outcome: How did you exit the trade?

Journaling this way is "night and day" compared to retrospective analysis. Engrams come through the pen actively; they do not always come through words retrospectively.

Case Study: The Altcoin "Drift of Death"

An example was provided of an altcoin trader who journaled a losing trade. The trader was tracking an altcoin coming down from a level monitored for weeks. They missed the initial fast interaction. They waited for a rebound, which was shallow and started moving lower again. Instead of waiting, they entered the trade late in the session, fearing they would miss out on more.

Overnight, the market executed the "drift of death" bouncing back to the initial rebound level they were waiting for, stopping them out, before finally moving back to the original short zone and panning out as expected.

[Level/Original Short Zone] <--- Missed Entry Here

\

\ (Fast Move Down)

\

[Shallow Rebound] <--- Desired Entry (Did not come)

\

\

[Late Entry/FOMO Short Here]

/

/ (Overnight Drift of Death - Stop Out)

/

V (Trade eventually plays out)

Retrospectively, the trader might invent various reasons, but the journal revealed the truth: “You were late to the trade and you just could not come to terms with it... So you took a poor entry because you thought you know better.”

Owning up to why you did what you did makes the difference. By journaling this way, patterns emerge within weeks. By the fourth week, one or two deadly patterns usually emerge, allowing you to target the glitch. By week 9, "gut feeling" transforms from theory to recognizable reality.

Developing Somatic Vocabulary and Practices

To utilize these insights, traders must develop a Somatic Vocabulary naming sensations accurately (e.g., heavy chest, lighter belly, rushing breath). Sensations show up differently for everyone, depending on factors like upbringing and relationships with parents. Mapping these unique signals is essential.

Key Practices:

The 60-Second Pause: When feelings of urgency kick in, pause for 60 seconds. This is when peak emotion slides, and the Nucleus Accumbens is least effective. Wait until the peak of emotion is out of the way before making trading decisions.

Rehearse Highs and Lows: Visualize setups, the hurt felt, and narrate/reframe them. Using a simulator to replay trades helps understand the internal processes.

Build Emotional Equity: A cheesy way of saying you want to train from alignment to sharpen the signal that creates the gut feeling. This is a process of micro-successes over many journaled trades.

Institutional Insights: How Top Earners Use Emotion

The most profitable traders do not just trade the chart; they trade their bodily sensations. They know the body doesn't lie and use gut feeling to alert them to great ideas or when to step back. This is how intuition becomes weaponized, and “that is where wealth begins in the nervous system.”

The Consensus Among Professionals

This approach is the best compass in trading, particularly useful after six months of experience. However, even traders with 10 years in the market who adopt this journaling perspective often discover knowledge they didn't know they possessed, pulling off effortless trades.

While often classed as secondary to technicals or macro, the body takes in billions of pieces of information faster than the conscious brain. Tapping into this is a game-changer. Yet “99% suppress emotions and never use them.” That is where they go wrong.

Historical context reveals that back in the 90s, top banks (who were bigger traders than hedge funds pre-GFC due to regulation) brought in experts such as Denise Shull to teach their traders about engrams and emotional cues, leading them to “significantly outperform benchmarks.”

The London Study: Reappraising Emotion for Profit

A study conducted analyzed over 110 institutional traders in London, classifying them into four groups based on experience and earnings. The findings on how they deal with emotions (wins and losses) were profoundly interesting:

This profound finding confirms that the highest level of success involves integrating emotional awareness into the trading process.

Market Analysis: Navigating the August Chop and Liquidity Drains (August 20, 2025)

Shifting to the market analysis, the current environment is characterized by a lot of chop. Many institutional traders are still on holiday and are expected to return during the last week of August. This return is anticipated to bring massive moves some fake-outs, some core moves. Until then, the market remains largely in observation mode, perhaps offering some day trades, but awaiting better situational clarity.

Equities (S&P 500, NASDAQ, Dow Jones) Facing Headwinds

The equity markets are showing signs of fatigue following the recent rally, primarily due to liquidity concerns.

S&P 500 Analysis

The S&P 500 has not moved much away from its peak produced at the end of July and is currently turning back down. There are two main reasons cited for this pullback:

Liquidity Drainage: The TGA is draining liquidity out of the market. When liquidity is drained, the margin accounts at brokerages shrink as well. Traders have less to risk. In an equity rally already highly characterized by fear, this reduction in risk appetite makes pullbacks very common and leads to choppy markets before a larger leap.

Inefficient Rally: The rally in late July was very inefficient. This inefficiency is likely going to act as a liquidity magnet, drawing prices back down unless there is a new liquidity injection. For the rest of August, no new liquidity injections are expected.

Outlook: Long-term, the trajectory has not changed and remains bullish. However, in the short term, expecting breakout rallies like those seen in July is considered “fanciful” at this stage. The US 100 (Nasdaq) and US 30 (Dow Jones) are following the same patterns.

Yield Dynamics and Forex Implications

The yield environment remains a critical driver for the Forex market, particularly ahead of potential shifts from the Federal Reserve.

US Yield Analysis

The US 10-year yield is currently choppy to range-bound. It very likely found a top at about 4.5% and is currently trading around 4.38% (or 4.3%). The expectation is for the 10-year yield to tour south as rate cuts start kicking in, as it typically follows the Federal Reserve's rate trajectory during a cutting cycle.

The US 2-year yield is now considered the barometer for the dollar. It recently bounced and failed to crack the 3.65% level. It is unlikely to crack this level unless there is a green light that the Fed is cutting rates below it.

Forex Outlook

USDJPY is highly influenced by the 10-year yield. The recent fake-out in early August is potentially sealing the deal, and the pair is expected to move more or less with the yield trajectory.

EURUSD dynamics are tied closely to the 2-year yield. As long as the 2-year yield stays above 3.65%, EURUSD is unlikely to go above the 1.17-1.18 levels. It is currently trading at 1.1636. While it could potentially tour back to 117, it is likely to remain elevated and choppy. A huge swing trade is unlikely without more clarity.

Key Catalysts

The next NFP data on 5th of September will shine more light on the Fed's stance. Additionally, this week features the Jackson Hole meeting, an event around which we have historically seen some mega reversals.

Gold (XAUUSD): The Superior Stagflation Trade

The outlook for Gold remains structurally bullish, driven by the macroeconomic environment. The current conditions suggest stagflation: the rate-cutting cycle is not done, there is inflation in the market, and growth is slowing down. Gold (and Bitcoin) tend to be superior assets in these environments.

However, the short-term price action required tactical adjustments. A long position initiated at 3,342 was forced to cut under 3,330. The rationale for the cut was the belief that the market wants to find more liquidity before it moves back up.

Re-engagement Strategy:

If the market moves up above the 3,340 levels.

If the market goes back down to 3,294, which is the bottom of that six-week cycle, presenting a potential long opportunity.

Bitcoin (BTC): Targeting the 111k Level

Bitcoin analysis suggests a near-term dip before a potential continuation. Bitcoin is likely to drop towards specific zones as part of the current six-week cycle.

Current Price: 113,089

Target Zone: Around 111,000, maybe a bit lower.

Outlook: There is hope for a bullish turnaround following this dip.

Action Plan: Engagement with Bitcoin will increase once it drops under 111k.

Key Market Levels Summary

Key Takeaways and Outlook

This session provided a critical framework for navigating the markets by integrating deep psychological awareness with macro analysis. The exploration of the Engram Trading Edge emphasizes that successful trading is not just about charts, but about understanding and utilizing internal bodily sensations. The conflict between the impulsive Nucleus Accumbens (NAC) and the intuitive Anterior Insula dictates outcomes. Mastering this dynamic through practices like Emotional Replay Journaling, the 60-second pause, and understanding your somatic vocabulary is a game-changer. As demonstrated by the 2016 "what not to do" experiment and institutional studies (where the highest earners make $80-90M/year), top traders weaponize their intuition by reappraising, rather than suppressing, their emotions.

In the current market environment, liquidity is the defining factor. The August chop is expected to continue until institutional traders return late in the month. Equities face headwinds from TGA liquidity drains and inefficient rallies, suggesting short-term caution despite a long-term bullish outlook. Yields (particularly the 2-year at 3.65%) are dictating Forex movements, capping EUR/USD below 1.18. Gold remains a strong stagflation trade (watching 3,294/3,340), while Bitcoin is expected to test the 111k level.

As we head toward the Jackson Hole meeting and September's NFP data, utilizing the engram edge will be crucial for identifying the real moves from the fake-outs expected when liquidity returns. It has been an incredible year so far, and the end of the year is expected to be even better, with new tools slated for introduction in September. Start journaling your Emotions trades preconditions, during, and outcome to build your awareness and improve your trading significantly.

Disclaimer: This isn't financial advice – just market musings from the charts. Always do your own research.

If you enjoyed this deep dive, please share it with fellow traders!

Amazing write up