The Secular Shift Is Here: How to Trade the Next Phase of the Cycle

Macro Pillar&Forward Strategy

We’ve traded through booms, busts, and pivots but what we’re watching now feels different.

We are entering what may be a new secular regime:

Yields trending higher

Liquidity cycling faster

Risk assets behaving wildly

Markets don’t care about narratives. They care about flows, positioning, and timing. If you know how to read the cycle, you compound.

Here’s the playbook for Q3.

📈 1. The Secular Yield Shift: This Changes Everything

The 10-year Treasury yield is breaking out of a 40-year downtrend.

That’s a macrostructural shift.

We believe the secular bottom is in at 3.5% and yields could touch 8% this cycle, barring a recession. This means:

Borrowing gets costlier

Equities face pressure via higher refinancing

Volatility returns in waves

🟩 Key Takeaway: This isn’t the 2010s. It’s starting to feel like the 1970s. Get ready to trade ranges, reversals, and real yields.

🧯 2. Liquidity Is the Market’s Fuel

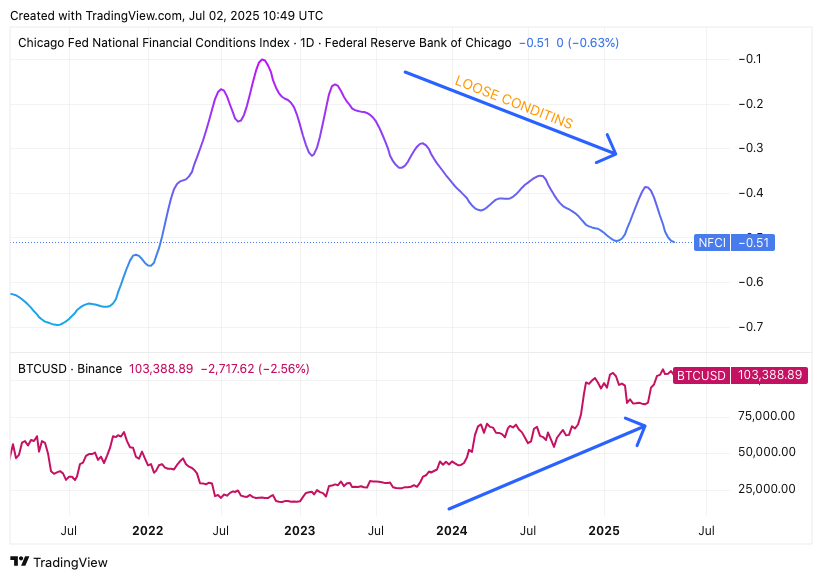

The Chicago Fed’s National Financial Conditions Index (NFCI) shows loose financial conditions, despite the Fed's “tight” rhetoric.

Translation?

Liquidity is sloshing, and that liquidity flows into high-beta trades like crypto and tech.

Falling NFCI = rising Bitcoin

Loose liquidity = short-term tailwind for risk assets

🟩 Key Takeaway: Liquidity is oxygen. Ride the wave, but always have an exit plan.

₿ 3. Bitcoin: Breakout Mode

BTC has held the breakout from $99K, eyes now on $112K–$120K.

Setup:

Long: $99.5K

Target: $112K–$120K

Stop: $94K

BTC is moving with real yields, and capital fleeing bonds is flowing to crypto.

🟩 Key Takeaway: BTC is a liquidity sponge. Trade it tactically, our original entry was published on 18th June.

💴 4. AUD/JPY: Slow Burn, Big Break

This one’s been grinding, but the macro supports a breakout.

AUD strength: fueled by China stimulus

JPY weakness: mild inflation, soft BoJ

Setup:

Long: ~92.00 average

Target: 97.00

Stop: 91.50

🟩 Key Takeaway: Don’t chase it. Let it base. Patience pays on slow-grind FX breakouts.

🇩🇪 5. DAX: The 27K Setup

Six weeks of grind higher and no sign of exhaustion.

Liquidity from German stimulus supports upside

Break above 25,000 opens up Santa Rally path to 27K

Setup:

Long: 23,300

Target: 25,000 → 27,000

Stop: 23,000

🟩 Key Takeaway: Discipline over hype. DAX is rewarding precision, not speed.

💵 6. Dollar Dynamics: NFP + QRA = Catalyst Combo

The USD is at a crossroads. Two events will dictate direction:

NFP – July 3

Weak print (<115K, >4.3% unemployment) = dollar bearish

Strong print = short squeeze

QRA – Treasury’s Borrowing Mix

More bills = more liquidity = weaker USD

More bonds = tighter liquidity = stronger USD

🟩 Key Takeaway: The dollar is a puppet, NFP and QRA pull the strings.

🌍 7. U.S. vs. Europe: Follow the Flows

SPY/STOXX ratio has flipped. Europe is now outperforming.

STOXX strength tied to policy, rotation, FX tailwind

S&P 500’s edge fading in euro terms

🟩 Key Takeaway: Flows don’t lie—capital is rotating. Europe is taking the lead.

📊 8. High-Conviction Setups (Q3 Core List)

🧠 Apple (AAPL): Chasing the NASDAQ

Long from 203

Target: 236 → 260

Stop: 190

🟩 High-conviction equity trade into Q3 strength

🟡 Gold: Still the Commodity Darling

Buy zone: $3,200–$3,290

Stop: $3,100

Target: $3,450+

🟩 Watch for breakout as real yields normalise

🎓 Final Thought: Trade the Cycle, Not the Narrative

This is the part most traders miss.

Everyone sees charts. Everyone sees headlines.

Very few know where we are in the cycle.

This quarter:

Yields are rising

Liquidity is loose

Assets are volatile

Catalysts are near

The edge isn’t in being early. It’s in being on time and right-sized.

🟧 [Join our Private Discord Server for Trade Alerts + Livestream Q&A]

—

Stay sharp,

Miad

Nice one, on aapl: Don't you mean long from 201? Instead of 231 :)