The Signal Just Fired

JPMorgan Just Flashed an 80% Win-Rate Setup And It's Happening Now

There are moments in markets where noise gives way to signal.

This is one of them.

JPMorgan Chase (JPM) a heavyweight of the U.S. economy and a leading proxy for the S&P 500 just triggered a high-probability pattern we track in our swing models.

We’ve seen this setup before.

When it hits, it resolves directionally and with conviction.

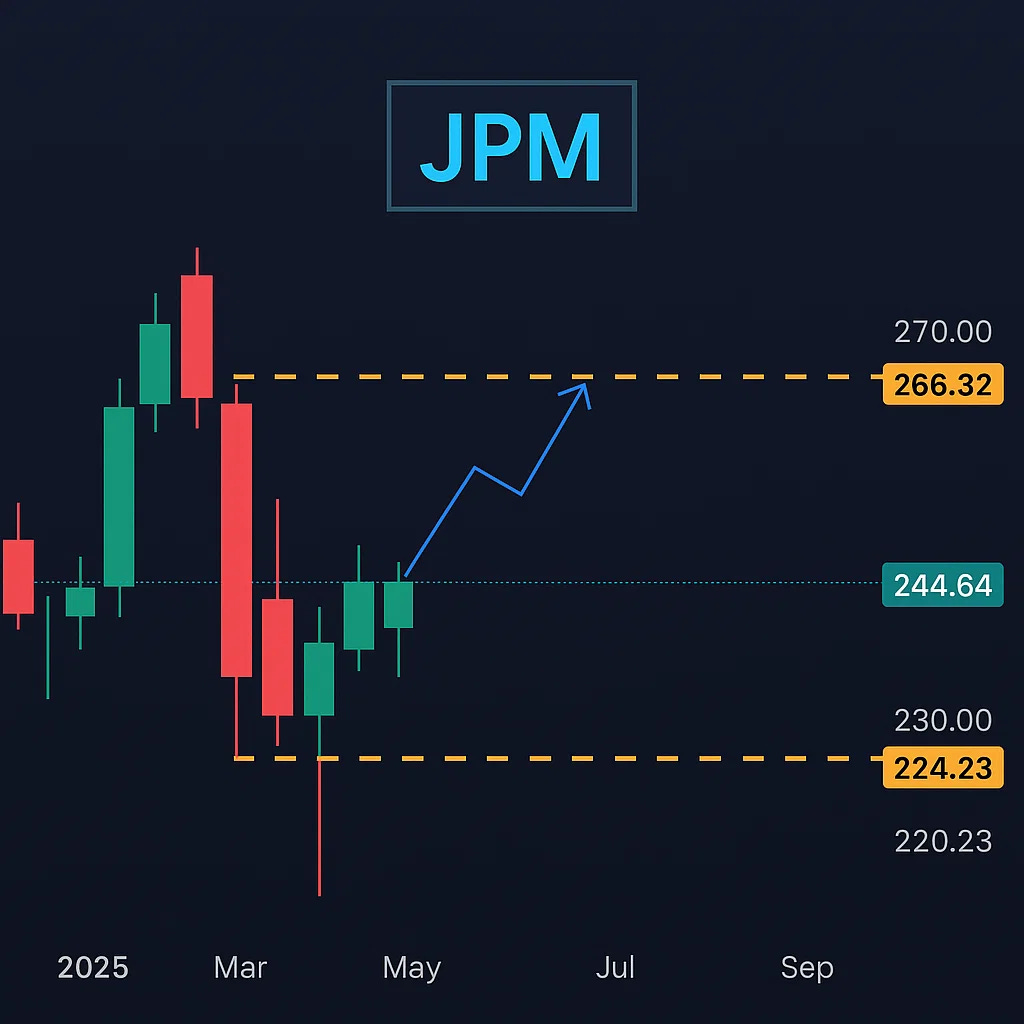

Chart 1: JPMorgan 2-Bar Inside Weekly Breakout

JPM – High Probability Pattern Setup in Progress

JPM is Leading The Economy

Here’s why this matters:

JPM’s price action is a real-time readout of the economic engine

When JPM breaks out, the S&P 500 often follows

It reflects liquidity, credit conditions, and forward economic momentum

Now let’s talk about why this signal is serious.

What Is an Inside Bar?

An inside bar is a technical pattern where price trades completely within the range of the previous bar no new highs, no new lows.

This means consolidation, compression, and buildup of energy.

When it happens on the weekly chart, it’s a key structure.

Here's the key: when you get two inside bars in a row, and pair them with our proprietary criteria, it creates an explosive setup with an 80% historical win rate.

This is one of those setups.

Why Most Traders Miss It

Most traders wait for the breakout.

But by the time the breakout happens, they’re late.

Worse many get trapped in false breakouts, where price barely breaks the high or low before reversing violently.

Our edge?

We don’t just look at the pattern. We map it against crowd behavior, volatility crush, and institutional signal a framework only shared inside our Discord channel.

The result is clarity.

The Setup Is Active Now

✅ Two inside bars on the weekly

✅ Proprietary filter criteria confirmed

✅ Trigger level active this week

✅ Historical hit rate: 80%

✅ Target: +8.7% upside from current levels

This is live.

You can wait but this trade won’t.

Why This Is Bigger Than a Trade

JPM isn’t just a bank. It’s a macro signal.

Its chart often leads the S&P 500 by 1–2 weeks, especially during key pivots. When JPM triggers risk-on flows tend to follow.

This is how pros front-run macro with micro.

Want Access to the Full Model?

We don’t post the proprietary filters publicly.

But the full setup including alerts, levels, and real-time discussion is available inside the private Discord.

🟩 [Request Access to the Swing Model Channel]

Final Word

This is what a real signal looks like:

Clear structure

Repeatable pattern

Real-world proxy asset

Historical edge

Defined risk

Directional upside

And most importantly it’s happening now.

Don’t miss it.

Miad