The Treasury Is Moving the Dollar—Not the Fed

And We're Approaching a Key Inflection Point

Everyone watches the Fed.

Almost no one watches the Treasury.

That’s a mistake.

Because right now, it’s not rate hikes or dovish speeches that are steering the value of the U.S. dollar it’s liquidity decisions from the Treasury’s bill and bond issuance strategy.

And if you understand what’s happening under the surface, you’ll see a critical inflection point approaching.

The Real Driver: Treasury Liquidity Injection

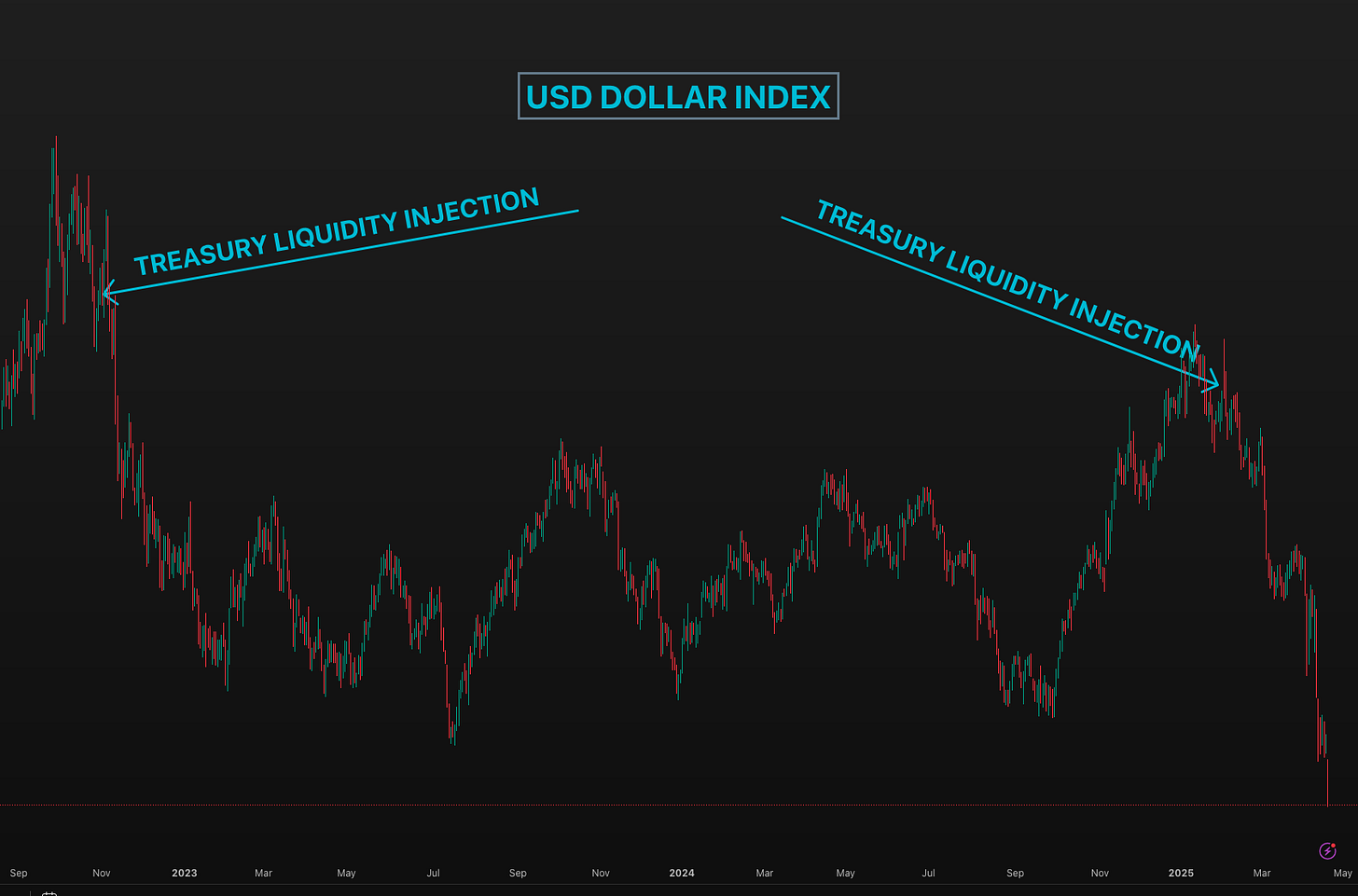

Take a look at the chart below:

(USD Dollar Index and Treasury Liquidity Injections)

It shows two major moves lower in the U.S. dollar each triggered by one thing:

➡️ Treasury liquidity injections via short-dated bill issuance.

This is not monetary policy. It’s cash management.

And it has massive, underappreciated implications.

October 2022: The Liquidity Turn

In the October 2022 Quarterly Refunding Announcement (QRA), the Treasury made a powerful shift: it leaned heavily into Treasury bills (T-bills) over long-dated bonds.

Why does this matter?

Because issuing more bills (which are short-term) increases near-term liquidity.

There’s less duration risk for buyers, more willingness to absorb supply, and it draws fewer dollars out of private markets.

The result?

🟦 The USD weakened

🟦 Global liquidity improved

🟦 Risk assets rallied

It was a stealth easing cycle engineered by the Treasury, not the Fed. And Completely Offset Fed’s Quantitative Tightening.

January 2025: No Change in Sight (Yet)

Fast-forward to January.

Despite growing market chatter, Scott Bessent (Treasury Sec.) kept the course steady no major shift away from bills.

In fact, the balance of issuance still favored short-term liquidity injection.

But Bessent made something else clear: he’s not likely to pivot anytime soon.

That’s the setup.

Why This Matters: A Dollar Dilemma

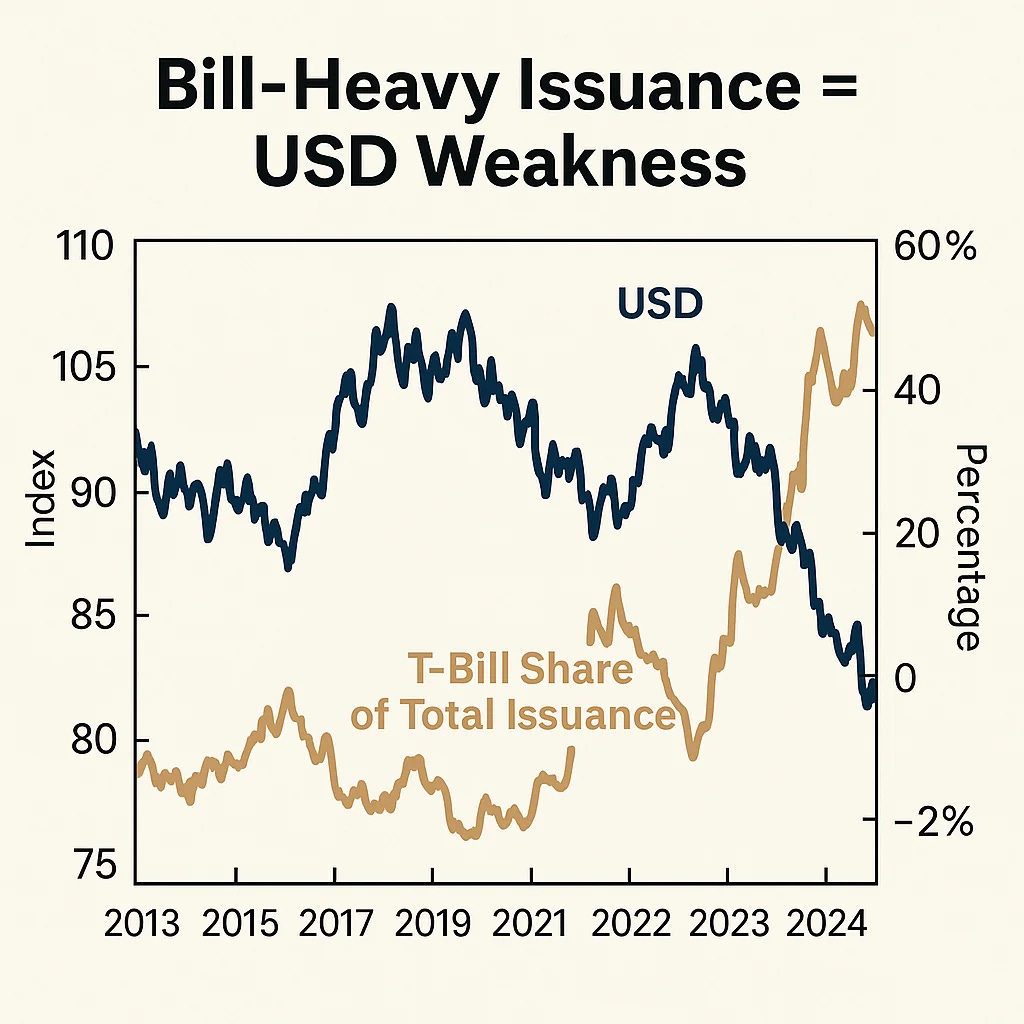

The mix between bills and bonds changes the supply of U.S. dollars in the global system.

When the Treasury issues more bills, it draws less cash from the system

→ Liquidity up, dollar downWhen it issues more long bonds, it soaks up more capital, parks it long term and drains reserves

→ Liquidity down, dollar up

So the bill-to-bond mix is now one of the most important liquidity levers in global markets.

Chart 2: USD vs. T-Bill Share of Total Issuance

(Bill-Heavy Issuance = USD Weakness, not exact representation)

The Next QRA: A Global Signal

All eyes should be on the next Quarterly Refunding Announcement.

Why?

Because this is where we’ll see whether the Treasury:

Continues to inject liquidity via bills

Shifts toward longer bonds and tightens the dollar

This isn’t a minor tactical choice. It’s a macro regime trigger.

If the Treasury tilts toward bonds → expect USD strength → risk-off

If the Treasury stays bill-heavy → expect continued USD weakness → liquidity tailwind

What Most Investors Miss

Everyone obsesses over the Fed’s next rate decision.

But the Treasury’s issuance strategy is faster, bigger, and more impactful in the short term.

This is where real macro traders look for edge.

And right now, the edge is simple:

The dollar is not moving on rate policy.

It’s moving on liquidity composition.

And that composition is decided by one event:

The Quarterly Refunding Announcement.

The Trade Setup: Wait for the Signal

We’re not front-running the next QRA.

We’re watching it with precision.

Because it will tell us:

Whether this dollar downtrend continues

Whether liquidity remains abundant

Whether risk assets still have room to run

What to Watch Next

In our discord server, we’ll cover:

The charts that map the USD to issuance mix

A breakdown of how bond-heavy funding affects risk premiums

How to use the QRA like a macro trader (not a retail spectator)

🟩 [Subscribe to get our Discord Server for instant Access to Trade Ideas]

Final Thought

This is not about yield curves or CPI.

This is about dollar supply.

And right now, it’s being controlled by the Treasury not the Fed.

(The next release is scheduled for April 28, 2025)

You just have to know where to look.

Miad