Trading Review: Asset Breakdowns and Deep Dives Research

Executive Summary

In this deep dive into trading mastery, we pull back the curtain on a critical six-week audit process that ensures we're on the right track, correcting missteps and leaning into winning strategies. We explore how auditing trades every six weeks aligns with brain science, where deliberate actions over three months rewire neural pathways, making the halfway mark ideal for adjustments. Reviewing past calls, positioning for future opportunities, examining trade outcomes, macro narratives, and execution flaws to build a robust trading business. We cover everything from GBPUSD's London fixes and bounces to AUDJPY's bullish yen pairs driven by inflation, DAX's perfect six-week cycle rallies, Bitcoin's high-reward dips using floating profits, gold's frustrating ranges since April, EURGBP's light entries, EURUSD's political devaluations, and USD's rally dynamics tied to yields.

Key catalysts include escalating geopolitical tensions like Iran-Israel providing Bitcoin buying opportunities, holiday impacts on July 4 affecting AUDJPY decisions, and upcoming events like FOMC, QRA, and GDP data shaping the next three months. We highlight successes, such as capturing GBPUSD shorts from untagged fixes and AUDJPY longs from 94 to 97, but also mistakes, like prematurely cutting AUDJPY positions due to price perception fears, costing substantial returns. Historical parallels abound: for instance, Bitcoin's mutant dives mirrored past scary drops, reloaded with floating profits, yielding excellent results up to the 118 handle. Auditing reveals when strategies like London fixes are "going strong" in July, hitting 80-90% in the right environment, versus choppy periods where you hold off.

We delve into the traffic light system for weekly convictions, the four pillars of trading (edge, risk, execution, psychology) as multipliers not adders, and the Q3 playbook's 22 setups mostly hitting targets. Broader implications include a secular shift to higher yields, making FX lucrative again, and research strategies dissecting bank reports like Danske's yield outlook for divergences. Risks? Liquidity suck from QRA borrowing $400B to rebuild TGA at $850B, potentially dampening equities via margin debt drops. Predictions lean bearish short-term on indices, with yen buys against dollar if yields hit 4.5 ceilings. Actionable insights: Use floating profits to leverage without drawdowns, score yourself dynamically on pillars (e.g., psychology at 8 after good sleep vs. 1 post-stress), and adopt the replay-reset-reload protocol inspired by polar bear trauma release to close emotional loops on missed trades.

Audit Process and Introduction

Six-Week Audit Rationale and Structure

The foundation of this trading audit lies in its timing: every six weeks, as it's the halfway mark to three months, where science shows deliberate actions rewire the brain's neural pathways. If you are on the wrong track, you can correct it. If you are on the right track, you can lean into it. This session, held on FOMC day amid QRA and quarterly refunding announcements, deviates from usual new trading elements to focus on self-auditing. We examine all trade calls, trades taken, outcomes, what was left out, and how research sets up success for the next six weeks. The goal? Ensure positioning to capitalize on opportunities when they arise. We scroll back to the last FOMC around June 18, reviewing CPI prints, 10-year auctions, and webinar follow-ups on asset outlooks.

No technique reviews here, educational resources cover those. Instead, it's about running the trading business: gauging strategy effectiveness like London fixes, six-week cycles, and inside bars, while keeping approaches partly discretionary yet effective. Questions are addressed throughout, building to a comprehensive view. For traders, this setup offers a blueprint: audit to query weak macro views or lean into solid ones, like recognizing macro regimes change and fixes may underperform in choppy narratives.

Key Takeaways:

Six-week sweet spot prevents full three-month detours.

Focus: Trade outcomes, research validation, opportunity positioning.

Actionable: Schedule your audits use them to amplify floating profits or correct perception biases.

Audit of Past Trades

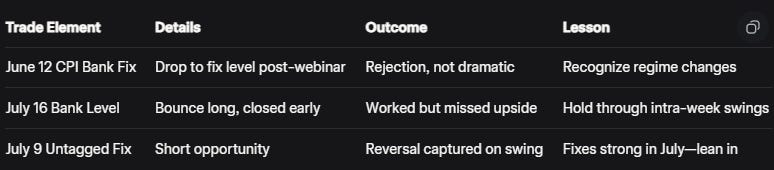

GBPUSD Analysis and London Fixes

Starting with GBPUSD on June 12, post-webinar: GBP has dropped back to the CPI bank fix we discussed during the webinar. Highlighted London fix importance the 4pm london time candle after the announcement. It showed strong rejection initially, then weakened, with the market favoring higher levels unrelated to fixes. Previous fixes were "somewhat good, but not as dramatic" as preferred, signaling macro regime shifts.

By July 16 the bank level bounce idea executed perfectly: went long earlier, closed on pullback, reloaded, but major long waited until Monday. The level worked, boosting confidence in fixes. Another untagged fix on July 9 led to shorts: it went up and down, reversed, captured on swing basis but not intraday. Textbook example, as we would say. Fixes "very strong" in July, e.g., flagging levels for "picture perfect" drops.

Historical context: In webinar, GBPUSD had drop space as fair value lower, EURUSD push faded early call nobody knew then. Environment key: Strategies work 80-90% in right setups, but need experience to engage. For traders, this offers setups like shorts into untagged fixes with 1:3 risk-reward, stops above fix opens.

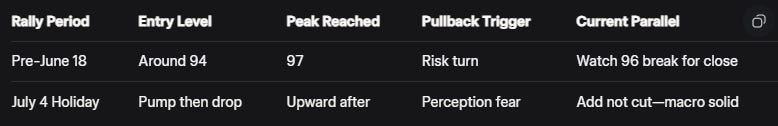

AUDJPY Analysis and Macro Narratives

AUDJPY reiterated around 94 amid yen pairs' five cups of macro, inflation driving up. Started lower, reached 97, now at 96 pulling back on risk turn may not hit 98 short-term. Entire six-week cycle bullish, profitable. Cose entire position if it drops below 96 in the short term. Audit highlights mistake: On July 4 holiday, 100-pip drop led to cutting position in half prematurely. This was a mistake because we let price movements affect decision-making when we did not have to. Perception feared 80-200 pip decline, but it pumped up significantly after full position would yield "much more substantial" returns. Next time: Add on pullbacks, as macro "spot on."

Further: Inflation, tariffs as hidden inflation goods creeping up, service buckle could shoot numbers. TIPS lower affects dollar pairs, positive for AUDJPY to 97-98.

Building on AUDJPY's inflation parallels, let's examine DAX's structural supports mirroring stimulus eras.

DAX Analysis and Cycle Performance

DAX at six-week cycle bottom: Macro bullish, allowed 0.5% leak before rally. This entire rally, this entire six-week period was just a sweet spot for adding, expanding, and closing as we reached all-time highs. Timing, trajectory "perfect"—nothing better. Structural support from European stimulus like 2020 post-COVID. Major options upside long-term, but short-term risk-off possible (detailed later). For traders, this offers adds at cycle bottoms with stops 0.5% below, targets all-time highs, risk-reward 1:4.

Key Takeaways:

Cycle leaks normal anticipate for adds.

Stimulus parallels: 2020 recovery vibes.

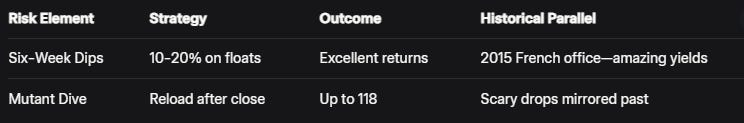

Bitcoin (BTC) Analysis and Risk Strategies

BTC six-week cycles: Risk 10-20% margin if confident, but only on floating profits not main account. If these dips had failed and dropped around here, it woud have eaten into the profits we made there. Leverage floating profits to avoid drawdowns, make money work. When people are in profit, they are afraid to lose it.

excellent results, account "substantially higher." Still holding to 118, close at 116 if broken. We waited a few weeks for all of this to play out. It was all worth it.

Geopolitical like Iran-Israel escalation gave buying opportunities.

As seen in BTC's floating profit parallels, gold's ranges offer contrasting frustrations.

Gold Analysis and Range Dynamics

Gold expectation: Hit abandoned fix, bounce, climb. It literally never hit it. Came close July 3, tapped briefly, busted through too choppy. This is not what we had planned. No intraday trades; held six-week longs but cut structurally at range top. Not long anymore, despite building market anxiety. Gold has not been going anywhere since April. Coiling for big move need research on reflation ties. July 10 load-up to range top, disappointing.

EURGBP Analysis and Layering

EURGBP: Entered light (2%) wanting lower loads European economy slightly better than UK. Went up without cheaper levels. Macro worked; six-week cycles allow layering floats. You could argue, why did you not buy in the previous cycle? Because we did not. The analysis was not there.

EURUSD Analysis and Political Drivers

EURUSD London fix post-ECB "worked perfectly" many posts on profits. Pointed both directions for Trump-Europe deal risks, fair value lower. We knew they were going to drive this thing back off. Political: Trump devalued dollar to pressure Europe (export economy) 10% currency up drops exports 30%. Europeans now agreed to an agreement, and EURUSD is falling off a cliff, and nobody knows why. That is why. Mirrored Yellen's yen devaluation last year on China 25% cheapening to destroy exports.

Hints: Strong dollar as trust, not level; 1.20 reaction point. Fair value around 1.1350. We try to bring to our research to ensure we are consistently profitable and hitting the bigger swings.

USD Analysis and Dynamics

USD devaluation political, not macro data said lower, but held for Europe pressure. Now rallying, no direct negative on risk assets. Big picture: Core hold, room to grow at year top layer later. July 17 sweet spot for aggressive GBPUSD shorts missed softly. This should have been way more aggressive. Thursday fixes as tops/bottoms for weeks post needed earlier positioning. Stats in London Fix course.

Traffic Light System and Four Pillars of Trading

Traffic Light System Overview

Manual weekly system: Read 50-60 articles, produce convictions bullish/bearish with levels. It is 100% me doing the research. AI prettifies. Use: Side with medium-high convictions, e.g., June 23 bullish indices captured week. Positioning key.

Four Pillars as Multipliers

Pillars: Edge, risk, execution, psychology multiply, not add. If your edge is 10, if your risk is 10, execution is 10, but psychology is 0.5, you are going to drag the entire thing down. Dynamic: Vary by environment, e.g., 90% setup risks 5-10% (floats higher). Psychology daily hydrate/sleep for 8-9 vs. issues for <1. Score self pre-trade for outcomes.

Key Takeaways:

Multiplier effect: Low psychology tanks all.

Actionable: Daily self-score trade only >5 average.

Q3 Playbook and Secular Shift

Q3 Playbook Successes

Amazing: 22 setups hit targets or rallied pure gold. Bullish gold/BTC/yen crosses/indices easy mode into July.

Secular Shift to Higher Yields

1980s yields topped, bonds rallied—now inflection to higher yields/rates long-term (60 years?). It is at this inflection point, and as a trader now, I think it is amazing to be around to trade these things. FX lucrative again, two-way vs. nonstop up. If you have a mortgage, try to lock it in for as long as you can.

Ethereum Analysis

Post on Ethereum week before QRA reports uploaded. Ties to broader crypto like BTC.

Audit Summary

Full roundup: Successes in directions/levels, improvements in communication/conviction (e.g., aggressive shorts), not fazed by minor actions like July 4 AUDJPY cut add instead. Going back to the last six weeks to see what went well, what went wrong, what is still working, what we need to improve on.

Additional Topics

Replay, Reset, Reload Protocol

Protocol for missed/stressful trades: Inspired by polar bear chase closes loops via pretend continuation/shake-off to release energy. Animals do this all the time... to release the trapped energy in them. Bypass fear/depression become apex predator. Develop own techniques.

Research Strategies

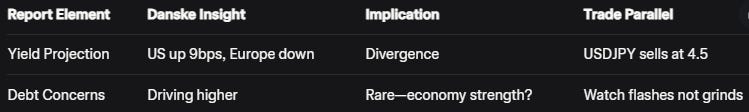

Report Analysis and Nugget Extraction

Strategies: Read bank reports (e.g., Danske yield outlook), remember agendas narratives sound good, but nuggets in between/what not said. No AI summaries engage personally, history/price reaction key. Example: Danske hinges on trade deal, projects US yields up 9bps in 12 months (4.41 to 4.50), Europe down divergence. Debt concerns rare as grind (flash like Liz Truss), more economy strength. QRA borrowing $400B for TGA $850B sucks $300-330B liquidity Q3, dampens equities via margin debt.

Yields-USDJPY tied: 4.5 ceiling tough sell USDJPY/ sell if hit. If yields cannot climb back up, then the AUDJPY trade is probably going to stop out at 96. Effort: 15-20 mins per report for solid ideas.

Cross-referencing yield divergences to USDJPY ceilings ties back to AUDJPY risks.

Key Takeaways and Outlook

This exhaustive audit reiterates the power of six-week reviews: Correcting tracks like premature AUDJPY cuts on July 4 (add on 100-pip pullbacks next), leaning into successes such as GBPUSD's "picture perfect" London fixes in July's strong environment, and using floating profits for BTC dips (10-20% risk, learned 2015, yielding to 118). Risks include liquidity drains from QRA's $400B borrow to $850B TGA, potentially leading to equity profit-taking and margin debt drops into August bearish indices short-term. Opportunities: Yen buys vs. dollar at 4.5 yield ceilings, given divergences in reports like Danske's (US up, Europe down); secular higher yields making FX two-way lucrative, lock mortgages long. Historical details shine: Political devaluations mirroring Yellen's 25% yen cheapening on China, Trump's euro surge dropping exports 30%; gold coiling since April for big moves; DAX's post-COVID stimulus parallels for continued upsides post-risk-off.

Actionable across assets: GBPUSD shorts to 1.3250 fair value (risk-reward 1:4); AUDJPY closes below 96; BTC holds to 118 with float leverages; gold range plays awaiting reflation clarity. Four pillars multiply score dynamically, psychology key. Traffic light for weekly easy mode; replay-reset-reload closes trauma loops like polar bear shakes. As we head into FOMC, QRA finals, and GDP, watch liquidity sucks for yen trades and index pain more charts/reports coming.

Disclaimer: This isn't financial advice – just market musings from the charts. Always do your own research.

If you enjoyed this deep dive, please share it with fellow traders!