Market Situation Report Part 2: Big Tech Earnings, FOMC Dynamics, and the February Buyback Surge

Executive Summary

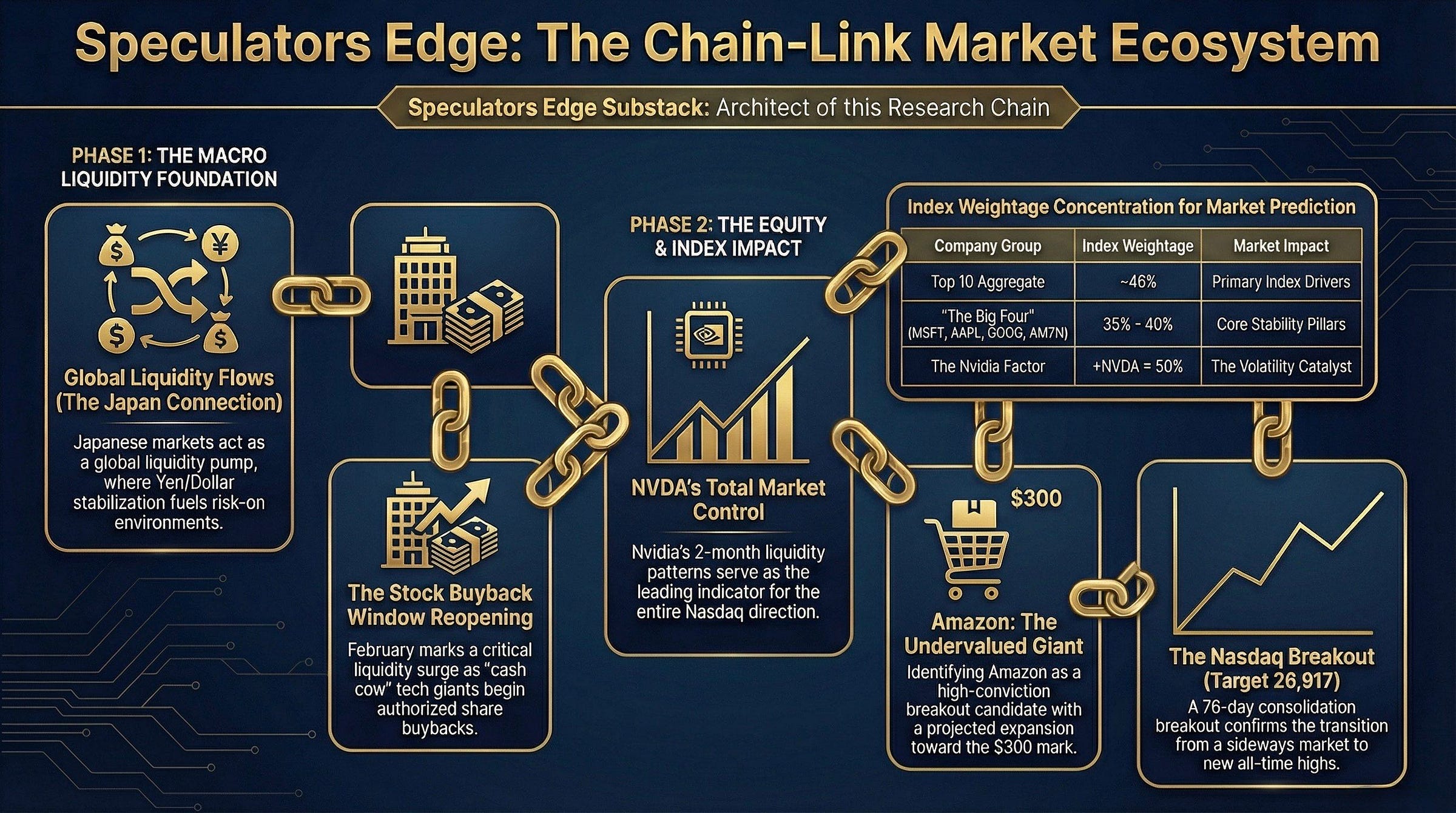

As we stand at the precipice of a monumental week for global finance, the convergence of the FOMC meeting, a heavy Big Tech earnings slate, and shifting liquidity cycles suggests we are entering a phase of significant market expansion. This report serves as a comprehensive roadmap for navigating the current environment, where the NASDAQ and S&P 500 are breaking out of a 76-day consolidation period. We explore the critical influence of the “Hyperscalers”: Microsoft, Apple, Google, and Amazon which, alongside Nvidia, now command a staggering 50% weight of the entire index.

What does this mean for your portfolio? It means that index direction is no longer a broad market sentiment but a reflection of a few key balance sheets. When Microsoft bottomed recently on a Tuesday, the NASDAQ bottomed in lockstep. This correlation is the engine of the current rally. We analyze the Rainbow Pattern: a rare alignment where the Monthly, Weekly, and Daily Opens stack atop the Yearly Open, signaling imminent and violent expansion. With the S&P 500 reclaiming its Yearly Open via a Bullish Order Block, the technical stage is set for a run toward all-time highs, with specific targets for the NASDAQ at 26,917.

However, with opportunity comes the “Death Zone.” We delve into the historical parallels of Nvidia’s 2021 liquidity cycle, a cautionary tale of how the market neutralizes liquidity on both sides of a range before a true trend begins. We also look ahead to the February Stock Buyback Window, a period where corporate “Cash Cows” inject billions back into their own shares, providing a seasonal tailwind that often masks underlying geopolitical risks. From Amazon’s un

dervalued robotics play to Japan’s snap election on February 8th, this post covers every major catalyst shaping the next 60 days of price action.

Index Weightage and the Engine of Market Influence

The current market environment is defined by an unprecedented concentration of power. To understand the NASDAQ or the S&P 500, one must first understand the handful of companies that dictate their movement. The era of a “market of stocks” has shifted into a “market of five stocks.”