February 2026 Outlook:

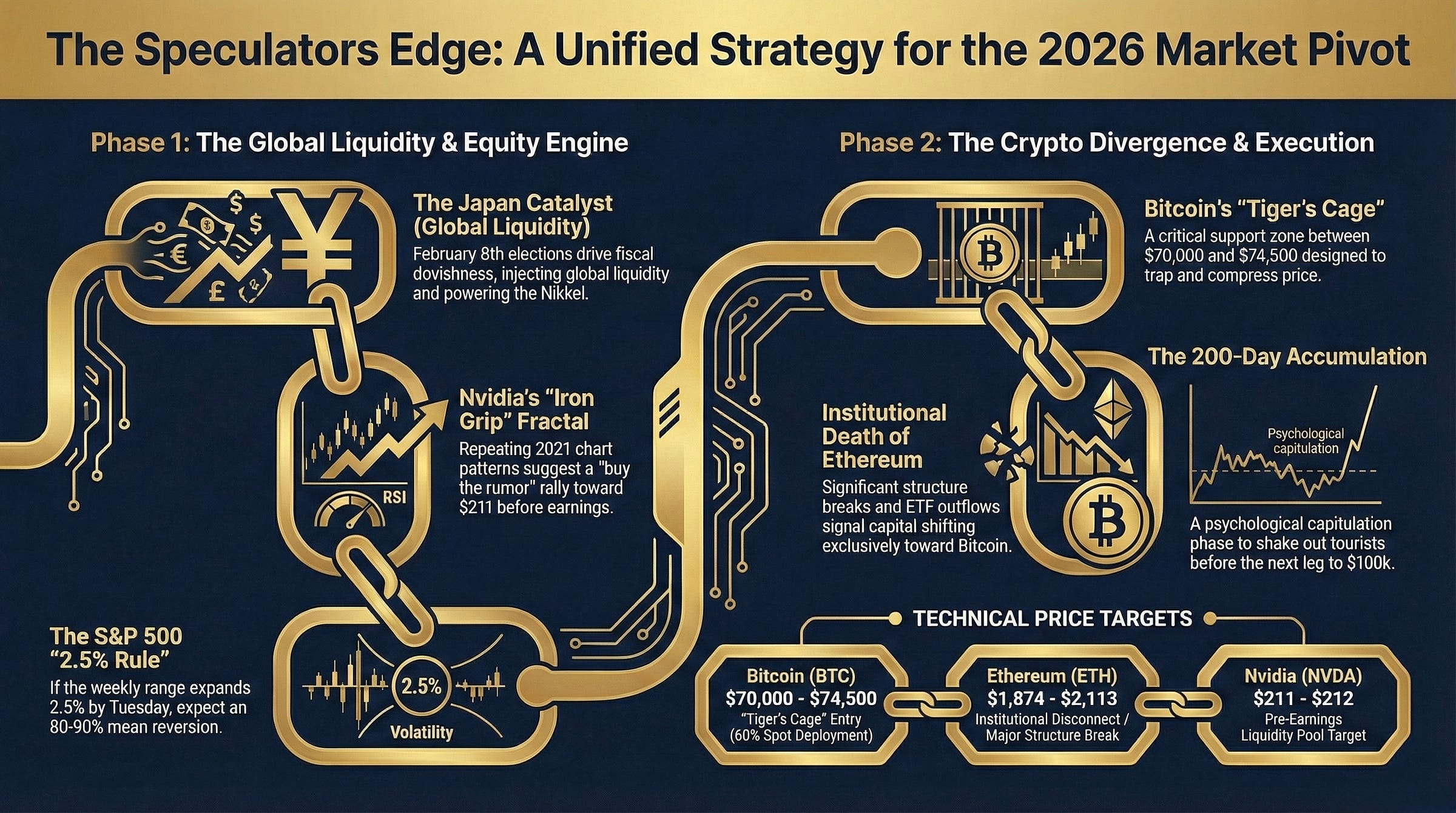

In February 2026, markets feel schizophrenic: crypto is plummeting while the S&P 500 and Nasdaq remain frozen near all-time highs. This stark divergence is creating confusion and whiplash for traders. Today’s episode cuts through the noise with proprietary research that argues the current stagnation is about to break. Listeners will discover why Bitcoin is entering a critical “tiger’s cage” support zone, why Ethereum faces institutional abandonment, and how a Japanese election this Sunday could ignite global liquidity. If you want clarity on whether this is a healthy correction or the start of something worse, this deep dive delivers actionable insight.

What is the discussion about?

The discussion translates complex technical analysis into clear, conversational language while preserving rigor. Listeners learn how fair-value gaps, six-month candle cycles, and ETF gap-fill rules shape price behavior. The episode contrasts Bitcoin’s structural retest with Ethereum’s broken quarterly structure, explains NVIDIA’s dominance over the Nasdaq, and reveals a practical 2.5% weekly range rule for the S&P 500. Commodity traders get a sobering warning about over-leveraged precious metals, and macro enthusiasts gain perspective on how Japan’s upcoming election could drive risk-on flows worldwide.

Research and Information

Proprietary analysis identifies Bitcoin’s $70,000–$74,500 zone as a high-timeframe fair-value gap sitting directly on the 2021 all-time high—creating the “tiger’s cage” where price compresses before reversal. Historical six-month candle data shows Bitcoin rarely sustains more than five consecutive bullish candles; we are now in the second bearish candle, implying a time-bound correction rather than a multi-year winter. The recommended tactic: wait for a sweep below $74,500, then deploy 50% spot capital targeting $100,000+. Ethereum, by contrast, has broken quarterly support with negligible ETF inflows, pointing to downside targets near $1,300–$1,360. NVIDIA remains underweight relative to earnings and is expected to rally into February 25 earnings before any sell-the-news drop. The S&P 500’s 2.5% weekly expansion rule offers an 80–90% edge for fading early-week strength. Silver’s monthly RSI nearing 98 signals extreme leverage that could trigger a 40% washout.

Conclusion

This episode distills a dense, data-rich research note into an accessible yet uncompromising market roadmap for February 2026. For the complete charts, statistical tables, and exact price levels referenced throughout the discussion, the original proprietary publication remains the definitive source: worth studying in full before positioning for the moves ahead.