Why listen to this Podcast?

In a world where global finance teeters on the edge of monumental shifts, the Deep Dive podcast delivers an urgent wake-up call for investors navigating the chaos of 2026’s markets. As the FOMC meeting, big tech earnings, and liquidity cycles collide, this episode unveils why the stock market has morphed into a “market of five stocks,” dominated by giants like Microsoft, Apple, Google, Amazon, and NVIDIA. Listeners gain invaluable edge by understanding these dynamics, avoiding common pitfalls like chasing breadth in a concentrated arena. Whether you’re commuting or strategizing at your desk, this podcast equips you with foresight to protect and grow your portfolio amid potential rocket launches or rug pulls, turning uncertainty into opportunity.

The Appeal

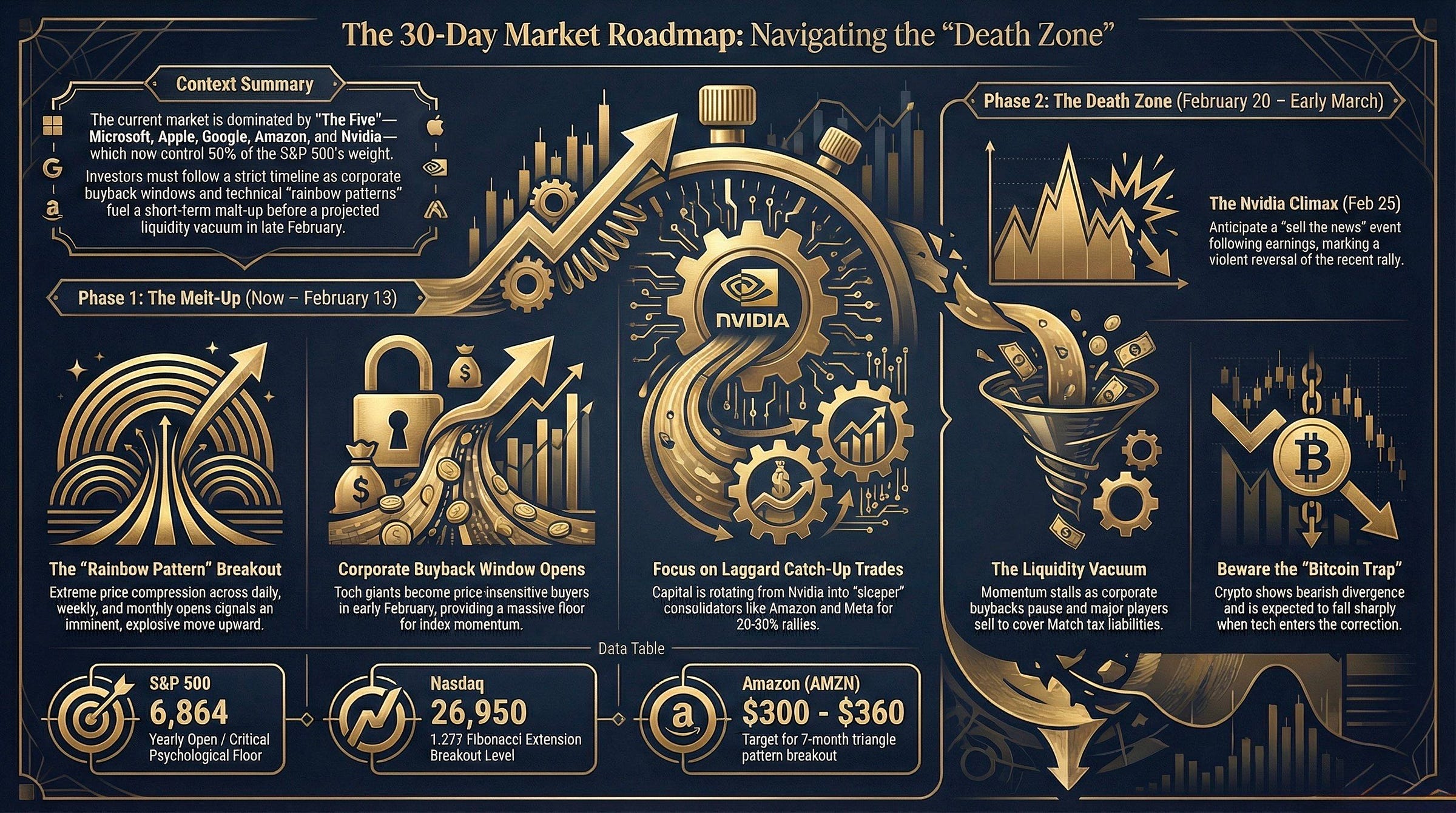

Diving into the contextual backdrop, the podcast explores how the S&P 500 and Nasdaq are breaking free from a 76-day consolidation, driven by technical setups like the “rainbow pattern” and bullish order blocks. Listeners learn about the interplay of hyperscaler health over broad economic signals, with real-world examples such as Microsoft’s role as the market’s pace car. It contextualizes upcoming catalysts, including Japan’s election on February 8th influencing the yen carry trade, and corporate buyback windows fueling short-term melts. This episode arms you with knowledge on divergence in crypto versus tech, urging caution against sympathy bounces in Bitcoin and Ethereum, all framed within a timeline that separates melt-up phases from looming “death zones.”

Research and Information

The podcast’s core draws from proprietary research highlighting concentration risks: the top five stocks now comprise 50% of the S&P 500’s weight, rendering the rest as “noise.” Trading insights include Fibonacci extensions targeting Nasdaq at 26,950, Amazon’s coiled triangle poised for 20-30% rallies to $300-$360, and Meta’s rotation potential to $788 highs. Warnings abound on NVIDIA’s earnings as a sell-the-news event around February 25th, with liquidity neutralization from exhausted buybacks and tax liabilities creating a risk-off period post-February 13th. Crypto specifics feature Bitcoin’s chop zone at 80K-90K, eyeing drawdowns to $74,508, and Ethereum shorts from $3,477 targeting $2,628, emphasizing relative weakness amid tech’s surge.

Conclusion

Ultimately, this Deep Dive episode masterfully charts a roadmap for the next month, urging long biases now while preparing for rotations and corrections to flush complacent capital. To grasp the full depth of these proprietary analyses and refine your strategy, dive into the original financial publication that inspired this discussion.